Economy Moderates — Too Much?

By Mel Miller, CFA® | Chief Economist

The third-quarter economic growth moderated from the torrid second-quarter expansion of 4.2% annualized, reflecting a healthy 3.5% growth rate. Did the pace continue to slow in the fourth quarter or did the economy rebound to the second quarter level? What is my forecast for 2019? My goal is to answer these questions.

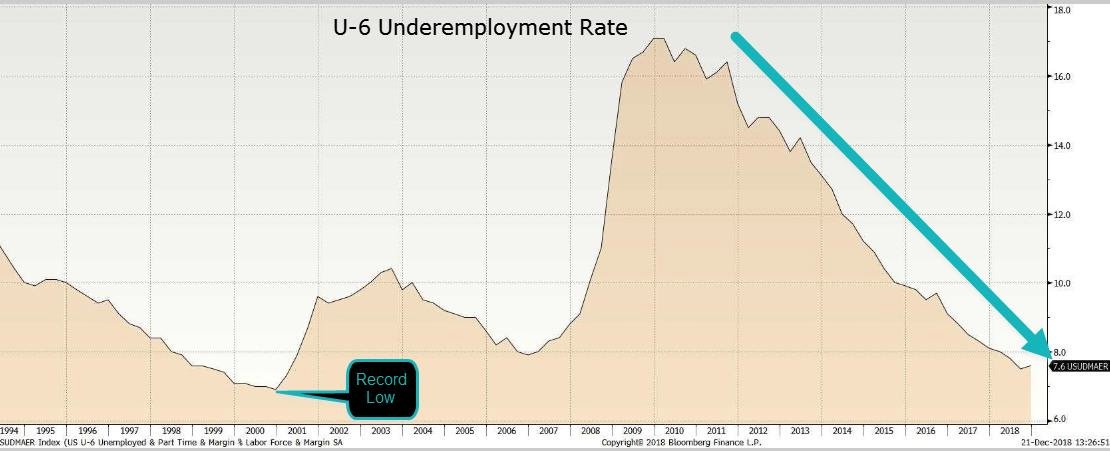

Let us first turn to consumer measures. The labor market continues to provide strength as the unemployment rate edged lower during the 3rd quarter of 2018 to a 48 year low of 3.7%. Some have noted that given the high job losses during the Great Recession which ended in 2009, many workers still are working only part-time while they desire full-time work. That indicator is called the U-6 rate. The rate reached an all-time level of 17.1% at the end of 2009 when it turned to a downward trend and now is at 7.4%, a level not seen since March of 2001. The U-6 is also influenced by employers avoiding paying benefits by hiring additional part-time workers. With the job-openings rate above the unemployment rate, this strategy will end. Look for the U-6 rate to continue to move lower even as the unemployment rate reaches a floor. Even the labor participation rate stabilized during the last couple of years, reversing the trend which started in 2000 as “baby boomers” began leaving the workforce and increasing the toll of the Great Recession by permanently increasing retirements.

A strong jobs market assisted consumers in strengthening their household balance sheets. According to Federal Reserve data, U.S. households debt service ratio is at an all-time low of 9.84%. Amazingly the all-time high of 13.23% occurred at the end of 2007. Households have been aggressive in paying off debt with their increasing income. Additionally, the personal savings rate at 6.2% has been steady for the last five years. Consumer optimism remains high, and wages are edging higher.

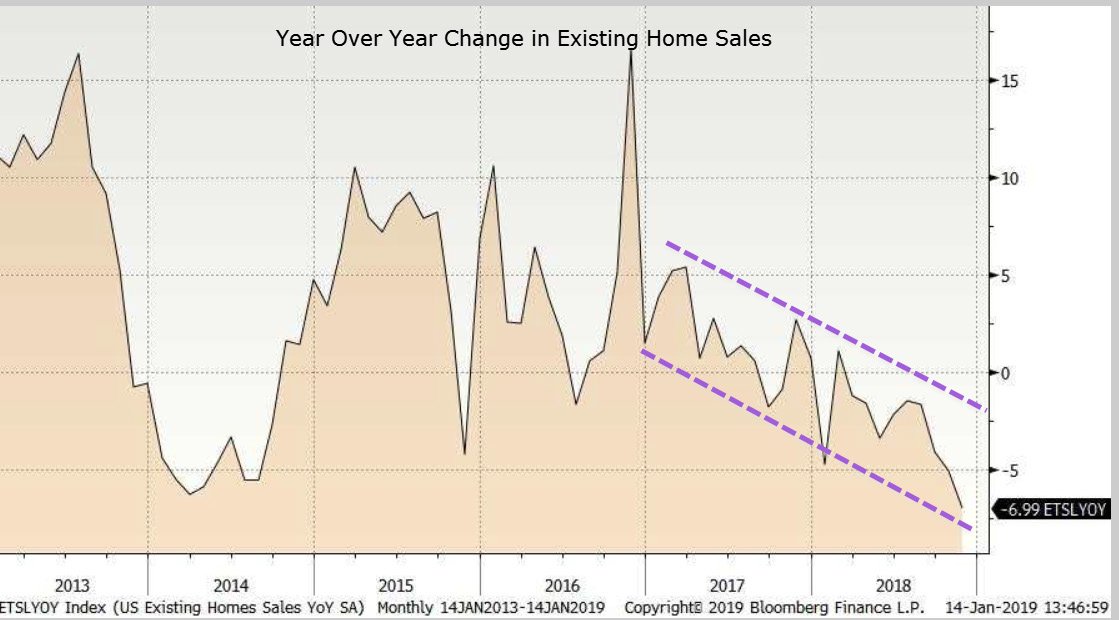

Given the optimism are there any areas of concern? Yes. Housing is trending lower for the last two years. Currently, existing home sales are down over 7% from last year. According to a recent study by Edward Leamer of UCLA, eight of the ten previous recessions followed downturns in housing. With rising interest rates and a shortage of affordable housing, the downturn is impacting the young the most. Home-ownership rates for those under 35 are still running below their long-term average.

There are many signs of strength in the economy, but there are signs of weakness, such as residential housing, slowing retail sales, slowing global demand and lack of business investment. The third-quarter GDP rose 3.5%, and I do not see the fourth quarter achieving the same level. I predict that the fourth quarter growth will be approximately 1% lower. Additionally, my forecast that the second quarter growth of 4.2% will be the highest in this cycle remains intact.

What is in store for 2019? Assuming the economy does not collapse into a recession during the first two quarters, the longevity of the economic expansion will exceed the previous record recorded during the Clinton presidency. Based on an analysis of my five recession predictors, I have raised my probability of a recession to 20% from the current 15%.

Today the fate of the US economy is determined by the actions of President Trump. Utilizing executive orders, he initiated tariffs (taxes) against all our trading partners raising the odds of a full-fledged trade war in 2019. The fate of the ongoing trade negotiations is the key determinant of future economic expansion.

The complexity of the economy makes predicting far from an exact science. Forecasters must rely on past similar scenarios and apply to the current situation. Since a full-fledged trade war is a unique phenomenon, this forecast is subject to above normal error and will depend on whether a trade “war” develops or is limited to the current trade “skirmish.”

Assuming a trade skirmish (no additional tariffs than exists at year end) my forecast calls for a slight slowdown in the economy along with below average stock and bond market returns. Assuming a full-fledged trade war (trading partners raising tariffs in retaliation to increased tariffs on imported goods above the year-end levels) the economy is likely to slow dramatically. The intense trade tensions, in my opinion, would produce a negative stock and bond environment.

One might ask why the severity of the trade issue is so important to my forecast? The main Chinese export is “deflation.” The United States economy’s foundation is high-tech innovation along with high labor costs. I heard an economist say “the U.S. does not make anything; it makes things up.” That is true. The design is the US input, while the Chinese primarily, and other low labor cost countries, manufacture the product. US manufacturing comprises approximately 12% of GDP while non-manufacturing 80%. A trade war with escalating tariffs challenges the current working model. Tariffs act as a tax, raising the price of imports and slowing the economy as reflected in my “Trade War” forecast. The Chinese government, as a retaliation move, could refuse to purchase additional treasury bonds or, heaven forbid, sell their holdings of US treasury bonds to increase our rates.

There are many risks to an escalating trade war, and the uncertainty around this issue will cause increased volatility for the economy and the markets as well.

2019 promises to be an interesting year!

Mel Miller, CFA® is Chief Economist and a member of the First Affirmative Investment Committee. He monitors economic conditions and market movements, and keeps the firm and its network advisors current on economic issues.

NOTE: Indexes are not available for direct investment. Mention of a specific company or security is not a recommendation to buy or sell that security. Past performance is never a guarantee of future results.

Source of graphic data: Bloomberg