Proxy Voting Gives Your Values Real World Impact

Your shares give you a vote and a voice.

Ever been to a corporation’s Annual Meeting? That’s where decisions about priorities, governance, and actions that could impact society or the environment are made.

As an investor, you have a voice and a vote on these decisions.

In short, you have a chance to make an impact that reflects all the reasons you chose Values-Aligned investing in the first place, but in the real-world decisions of the companies you’ve invested in.

That’s why First Affirmative makes it easy to vote your shares. Whether just a few shares or many, your vote will be counted.

Too many firms and funds hide behind “greenwashing” – claiming values-aligned credibility without the research, care, proxy voting and customized portfolio construction that prove to shareholders that their investments reflect their values.

In many cases, they hope you don’t look too closely or do your own research. With mutual funds and ETFs, it’s “you get what you get.” Not with First Affirmative.

We do the homework for you.

Working with our trusted partners, our world-class investment research team investigates thousands of companies’ actions, public records, and investments, to determine what is true values-aligned compliance and what is lip service.

Our Portfolio Construction Process customizes values-aligned investments without sacrificing financial goals:

We customize portfolios to dovetail your values with your financial objectives and risk tolerance, combining our proprietary research and thoughtful portfolio construction techniques. We go further than most firms in the industry, customizing values-aligned portfolios down to the individual companies you wish to include or exclude. You choose exactly where you want your investment dollars to go – or not go. No more, “you get what you get.”

We Vote Your Shares and Advocate for Values-Aligned Impact:

Voting your shares can be expensive, time-consuming and even a little intimidating. That’s why we’ve done the homework for you: to make it easy for your vote to reflect the change you want to see in the world.

- We vote your shares (when you authorize it) according to our values-aligned compliant Proxy Voting Guidelines;

- We provide a comprehensive annual review of our proxy voting record; company by company voting information is available upon request.

But it doesn’t stop there. Our Advocacy Program goes a step further. We build coalitions with other like-minded groups, pressing for real change, real action. We are proud of our track record of engagement on clients’ behalf.

All of this makes First Affirmative your best choice for seeing real impact from your investment dollars: your values turned into a voice that gets heard, a vote that gets counted and stands together with others who want to push for real change.

Why Does Proxy Voting Matter?

Values-Aligned Investing is important – but it’s only part of the equation. Investing gives you shares; shares give you a voice and a vote in how a company is run. But to get long-term impact and make sure your vote is counted, you must vote your proxies, or have a trusted advisor vote them for you.

What is proxy voting?

As advisors, we are responsible for our clients’ voice. We recognize that values-based investors have multiple objectives: In addition to potential economic gain, First Affirmative clients are concerned with good corporate governance, the ethical behavior of corporations, and the impact of corporate actions on a healthy society and the natural environment that supports it. We believe that companies implementing best practices in values-aligned issues enhance their ability to maximize shareholder value. We also believe that companies that take actions contrary to sound best practices with regard to values-aligned issues may contribute to systematic risks and associated costs that may adversely impact our clients’ portfolio performance.

We’ve developed Proxy Voting Guidelines for each category. Check out the thinking and actions behind the issues that matter most to you below, or view the full Guidelines here.

That’s why First Affirmative matches its customized Values-Aligned investment platforms with one of the most active, thorough and effective Proxy Voting/Advocacy/Impact programs in the world.

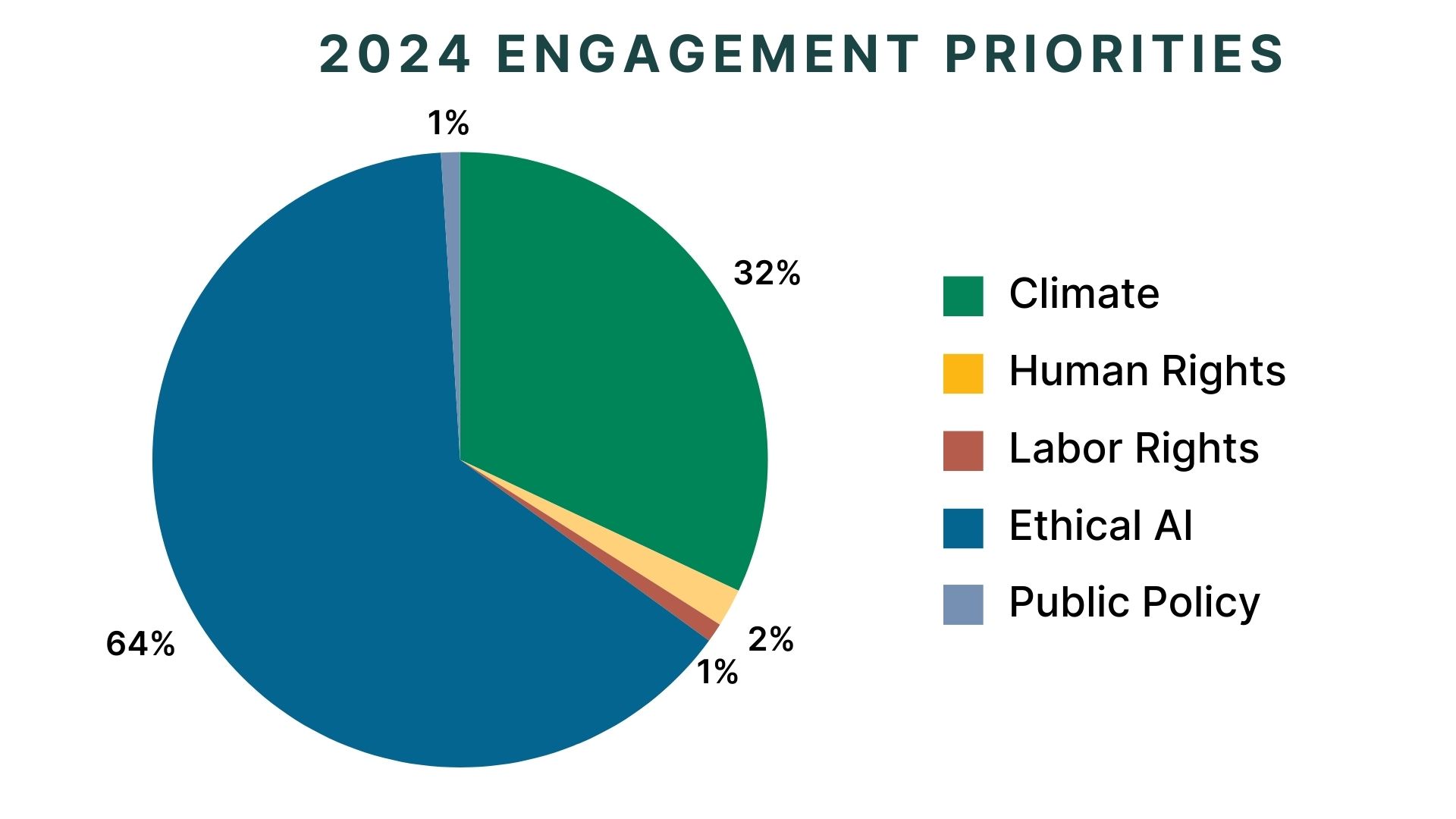

Our record speaks for itself. Check out our 2024 Proxy Votes and Engagement Report.

Proxy Voting FAQs

How does First Affirmative vote my shares?

If you delegate proxy voting to First Affirmative, we will review proxies on your behalf and vote each qualifying share in accordance with our stringent, values-based proxy voting guidelines. This is part of our comprehensive service and proxy voting is included in our fee.

I don’t own many shares. Does my vote still count?

Yes! Each qualifying share will be voted, regardless of how many shares you own or how large your account is.