By Theresa Gusman and Mel Miller | Download the PDF

We are going to try and answer the question of “What is an investor to do?” Going into 2020, the economy and the market seemed on reasonably stable ground. Expecting the record-breaking eleven plus years of economic expansion to continue, the stock market, as measured by the S&P 500, reached a record level on February 19th.

What has caused the dramatic change in less than a month? The expanding coronavirus pandemic, disrupting life and supply chains in addition to existing restrictive trade policies, has roiled the markets as valuation measurers become meaningless. Short-term investors and speculators sought safe havens. Gold and treasury bonds became the investments of choice as both gold and the treasury index recorded approximately 10% returns since February 19th. Amazing.

The key to creating long-term wealth has always been to distinguish between being a long-term investor and a short- term speculator. We know it is difficult given the current uncertainty not to concentrate on the short run, but historically long-term investors treat stocks like any other asset. When the asset goes on sale (price declines), they are inclined to buy more; not sell. One of the best long-term investors, Warren Buffet, recently stated, “Long-term outlook not changed because of the coronavirus.”

Market volatility is likely to continue for some time, and we do know some facts. A bull market follows a bear market. Bear markets last on average, 18 months, but they do end. Like humans, markets are resilient. This, too, shall pass: It is reasonable to believe that within a year, a vaccine will be available, and the coronavirus merely a bad memory.

Just the Facts

Rather than attempt to predict near-term market movements, we will provide the facts – on the virus, the markets, the earnings outlook, Central Bank actions, and recently announced stimulus packages. Recognizing that no two bear markets are the same, to the extent possible, we will put “the facts” in historical perspective as a frame of reference.

The COVID-19 Coronavirus Pandemic

As of the morning (ET) of March 16, 2020, more than 173,117 cases of COVID-19, the disease caused by a new strain of coronavirus, had been diagnosed worldwide, and 6,664 people had died. The virus has been detected in 119 countries and on every continent except Antarctica. The United States has 3,802 confirmed cases in more than 40 states, and 69 people have died. This link provides continuous updates: https://www.worldometers.info/coronavirus/.

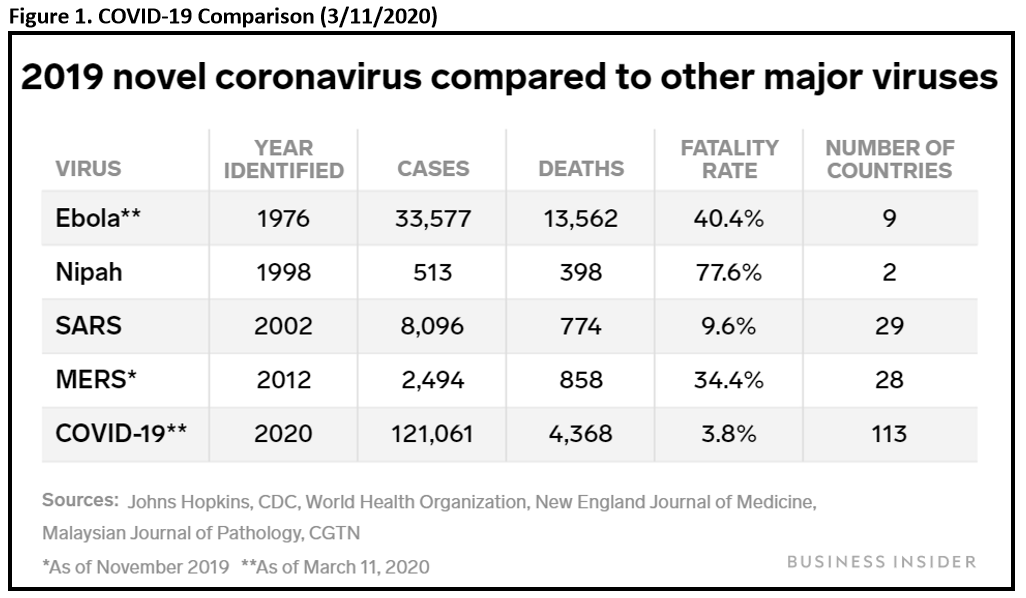

Below is a chart comparing the spread of the COVID-19 coronavirus to other major viruses. As you will see, although the fatality rate of the new virus is lower – and concentrated among the elderly and infirm – its spread and breadth are far, far higher. US cases are escalating rapidly, a 33% increase every day, or doubling every three days. The public and private responses – States of Emergency declared; community quarantines; canceled concerts, sporting events, and large gatherings; cruise lines, theme parks, stores, and restaurants shuttered; schools closed; store shelves cleared; employees advised to work remotely – have been immediate, unprecedented, and personally and professionally jarring.

The Equity Market Response: FEAR!

As many of us learned in our first days as investors, research analysts, portfolio managers, and market observers, two things drive the market – fear, and greed. With the US equity market persistently hitting new highs in 2020 following a 31.5% gain last year, it’s evident that the latter drove the Dow Jones Industrial Average above 29,500 – with 30,000-plus just over the horizon – on February 12th. Then it became apparent that the economic, financial, and personal impact of the coronavirus could not be contained “over there,” and the rout was on. The Dow has since plunged 28% to just over 21,200 on March 12th. To put this in perspective, the Dow fell 54% during its 2007-08 collapse, and it took 6 years for the market to regain previous highs.

To put this in perspective, the Dow fell 54% during its 2007-08 collapse, and it took 6 years for the market to regain previous highs. We are loathe to say, “this time, it’s different”. However, both the economy and the market were, in fact, on reasonably stable footing as we entered 2020, and the policy response to the virus has been both fast and aggressive – which could shorten the blow.

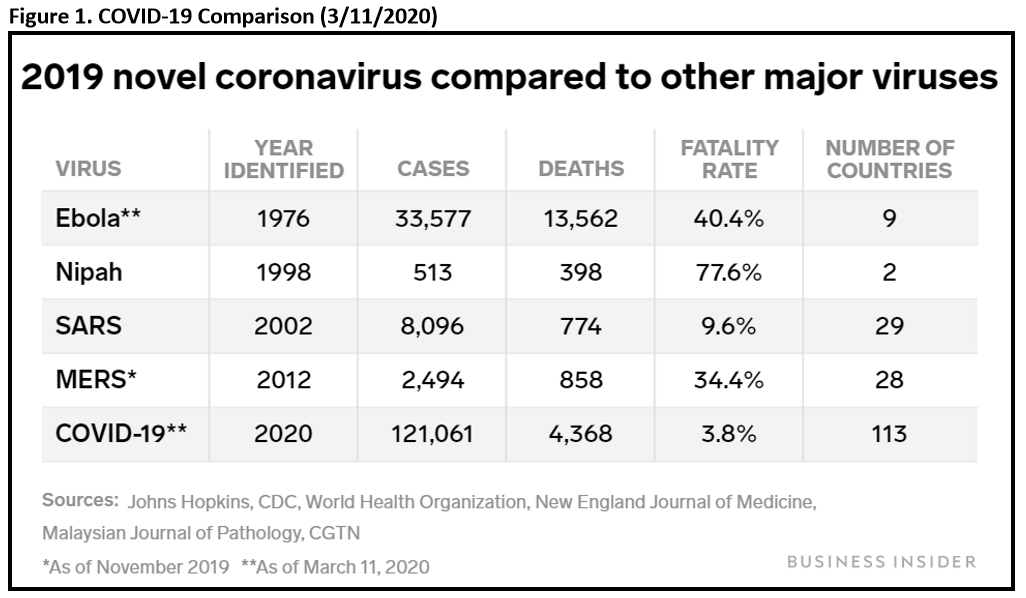

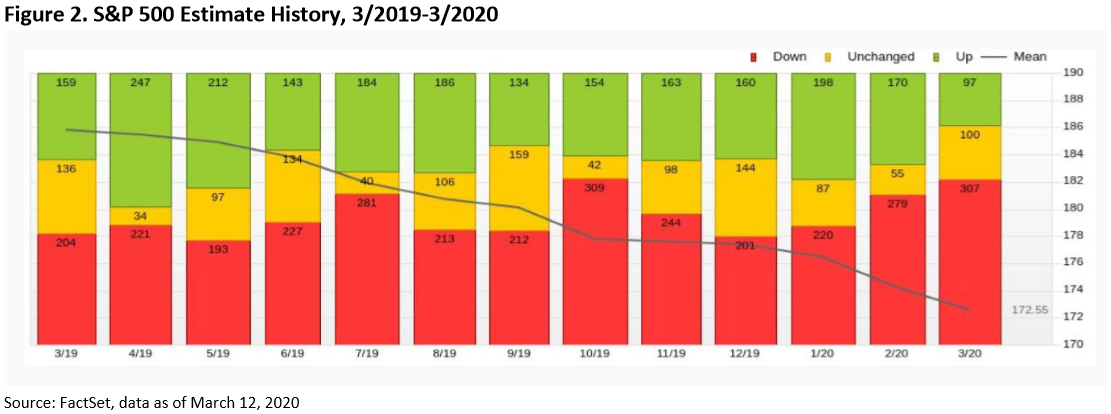

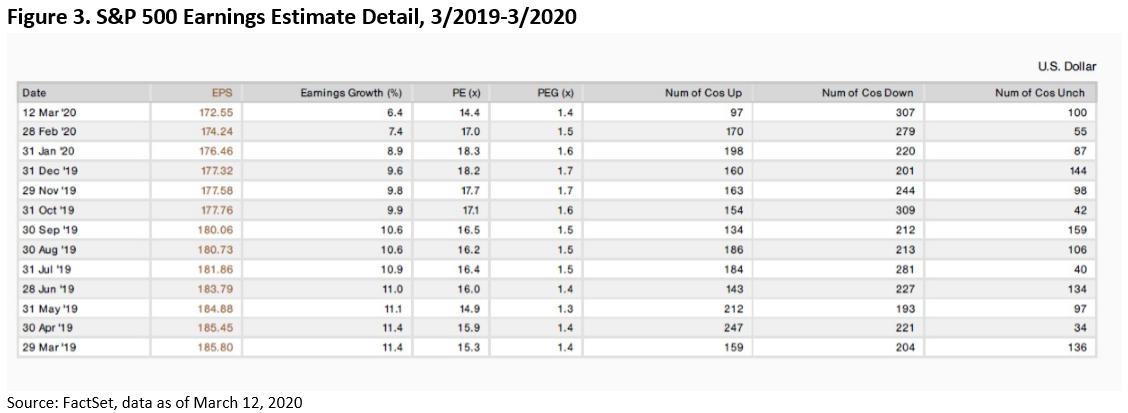

As the prospective earnings impact of the coronavirus became apparent, estimates declined, as shown in Figure 2. According to FactSet, analysts have slashed forecasts for more than 60% of S&P 500 companies this month through March 11th, after reducing more than 50% of estimates of last month. That said, projections continue to call for a 6.5% earnings increase (see Figure 3) for S&P 500 companies in 2020 – which is clearly unrealistic in the current environment. We have noted similar declines in 2020 DJIA, MSCI ACWI, EAFE, and Emerging Markets earnings projections, and can provide this information on request.

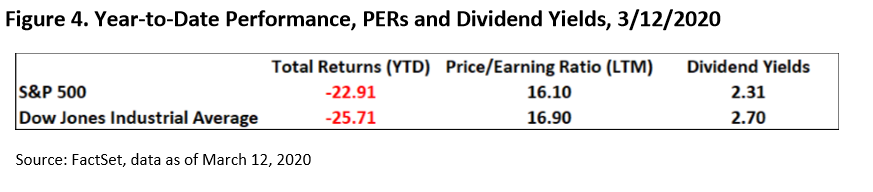

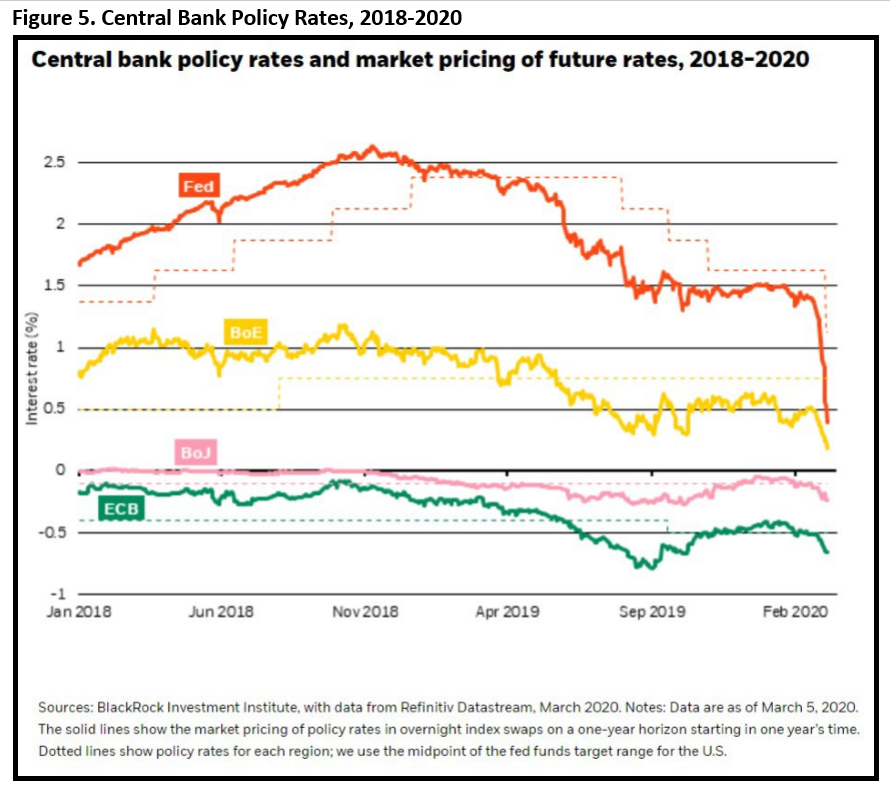

The year-to-date performance data for the key US market indices are presented in Figure 4, along with the price-to- earnings ratios and dividend yields of each market. Ultimately, lower valuations and rising dividend yields – particularly in a falling interest rate environment (see Figure 5) – will deliver a market bottom.

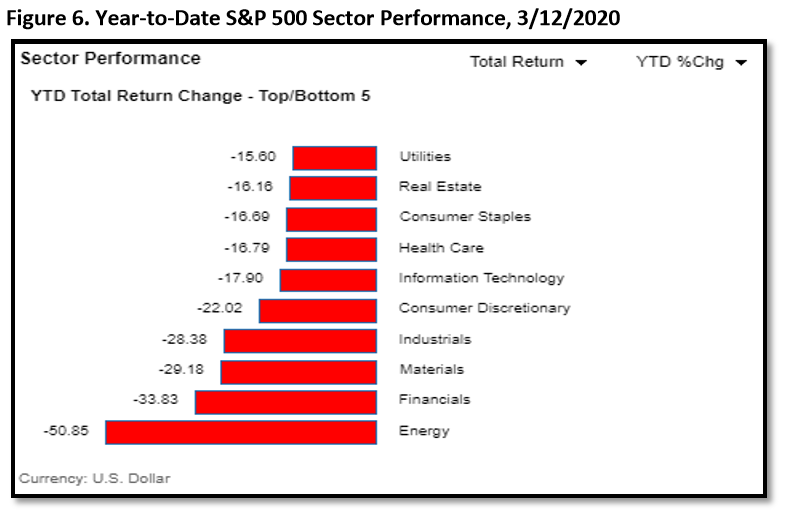

From a sector perspective, the worst-performing sector by far has been Energy, which has fallen 50.85% year-to-date. Of course, the Energy sector has been hurt by the combination of plummeting demand in the wake of the coronavirus and increased supply from Saudi Arabia and Russia amid OPEC’s biggest spat in years. Utilities (-15.80%) has been the best performing sector year-to-date. Please see Figure 6 for details.

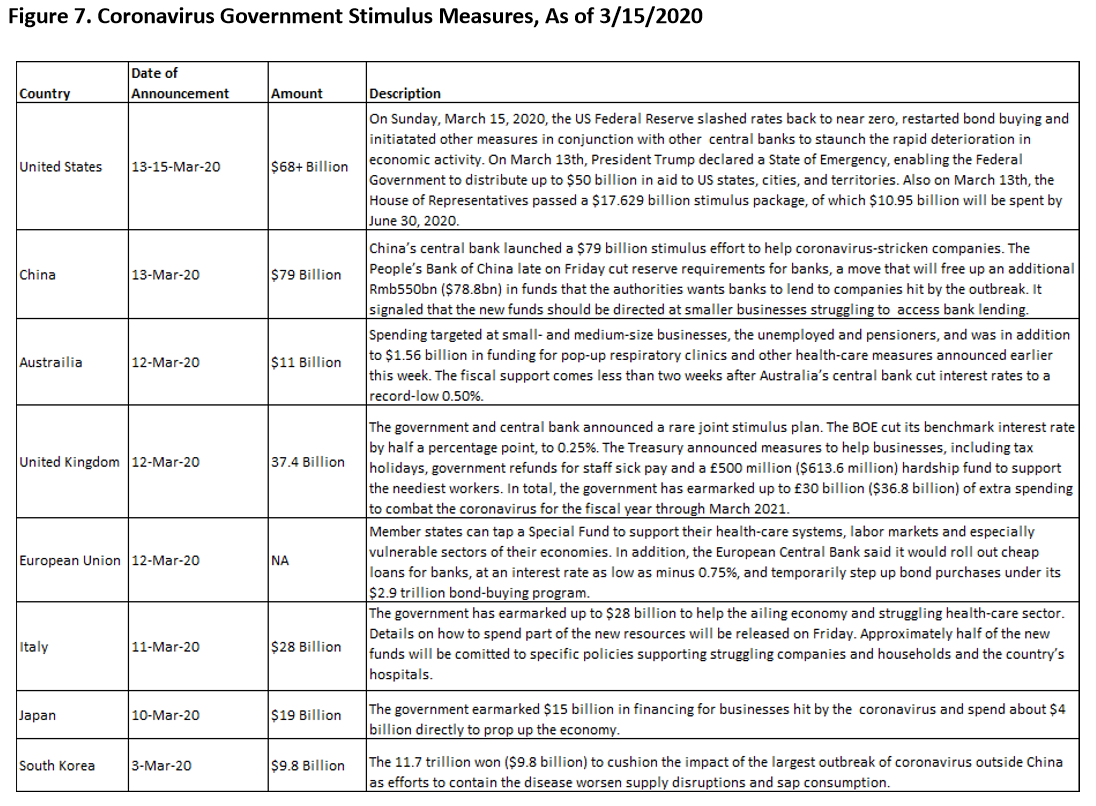

The Government Response

Government and corporate edicts, public panic, and plunging markets have elicited rapid, large stimulus responses across the globe. We have documented many recently announced stimulus packages in the table below (see Figure 7). The disastrous Chinese economic statistics released this morning – industrial for the combined months of January and February fell 13.5% from a year earlier, and retail sales plunged 20.5%. With the rest of the world following China’s lead on travel restrictions, quarantines, and closures, it is clear that the worst is yet to come globally, and additional stimulus will be required to jump-start global economic activity once the worst of the virus passes. We will update Figure 7 and post it to TI as additional information becomes available.

Conclusion

The number of coronavirus cases outside China will continue to increase – perhaps parabolically – in the near term. As public and private virus containment efforts become effective, the number of cases will level off and eventually decline. With this decline, life will return to “normal,” and global economic activity will resume (it appears that it will come to a near standstill – unless you produce food, hand sanitizer, or toilet paper – first), and the markets will recover. Humans are resilient, and so are the markets.

As always, everything we do at First Affirmative is driven by our dedication to enabling advisors to deliver financial results to clients and belief in the power of capital to bring about lasting environmental and social change. Our three Sustainable Investment Solutions – Custom, Multi-Manager, and Managed Mutual Fund – are built to enable clients to achieve their financial goals over the long term, along with their individual environmental, social, governance (ESG), ethical, and valuesbased objectives. Each portfolio is carefully constructed to be well diversified across assets, sectors, geographies, securities, and management styles –– and designed to weather periods of uncertainty and volatility.

Stay safe and take care of yourselves and your families!