AffirmativESG

What sets AffirmativESG apart?

Our proprietary Sustainable Investment Solutions.

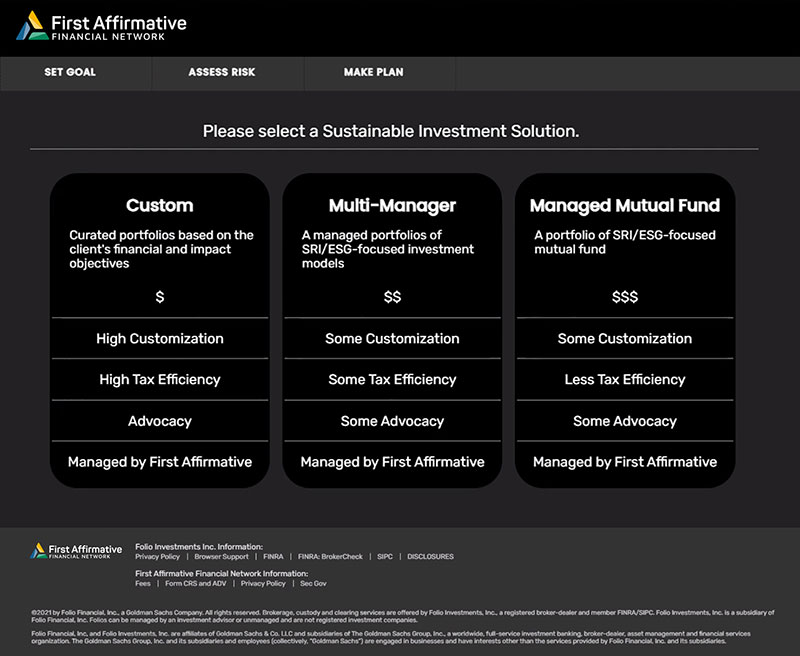

Our proprietary Sustainable Investment Solutions. Powered by First Affirmative’s research, analytics, and due diligence expertise, AffirmativESG delivers three distinct outcome-oriented strategies to meet each client’s needs. Each solution is crafted with our clear, consistent, and repeatable ESG investing process. Choose the best solution for your clients:

- Custom Sustainable Investment Solution (CSIS)

- Multi-Manager Account

- Managed Mutual Funds

Levels of ESG Customization.

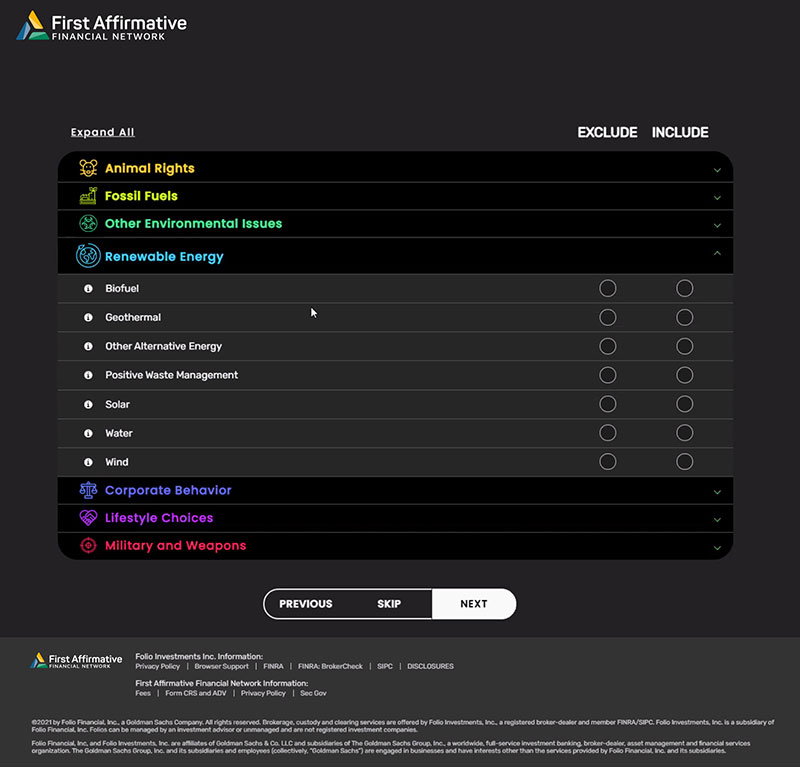

How do you want to change the world? With over 50 client impact preferences categories available, your clients’ portfolios can be fully customized to meet their individual environmental, ethical, and social objectives. Include or exclude securities from the following major categories:

- Animal rights

- Fossil fuels

- Renewable energy

- Other environmental issues

- Corporate behavior

- Lifestyle choices

- Military and weapons

- Racial equity

How do you want to change the world?

Tomorrow’s technology, delivered today.

AffirmativESG offers:

- Customization across a range of client inputs, including risk tolerance and time horizon, in addition to ESG concerns, so that you can scale and grow your business;

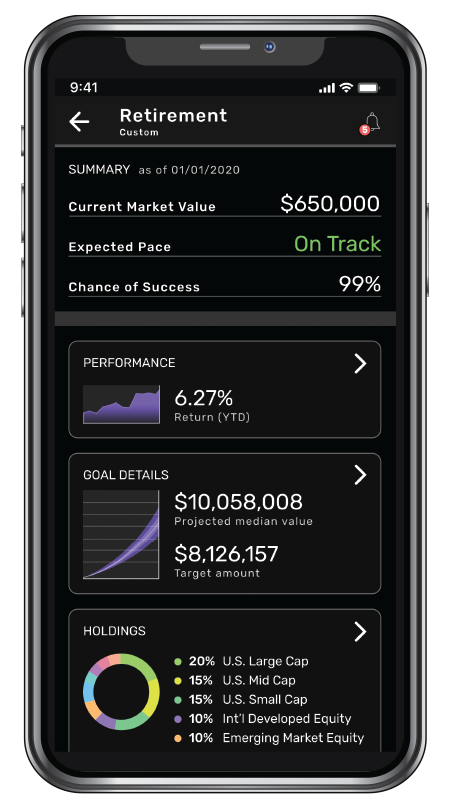

- Goals-based financial planning, whether the client is saving for retirement, a major purchase, or a child’s education, or simply building wealth;

- Automated portfolio construction, IPS generation, reporting, and more;

- Tax optimization, including tax-lot-relief strategies designed to support a wide range of needs, as well as targeted tax gains or losses; and

- Enhanced trading capabilities, including fractional shares and dollar-based investing.

The connected advice model necessary today.

Fully engage your clients in the “new normal:”

- Reduce or even eliminate the need for in-person client meetings with our completely paperless, automated account opening process.

- Be there when your clients need you through the platform’s advanced co-browsing capabilities.

- Give your clients access to their portfolio anywhere, anytime through our mobile app, downloadable for iOS or Android devices.

ESG-focused.

Customizable.

Client-connected.

When you experience AffirmativESG in action, you’ll see the possibilities for your practice.

Ready to learn more?

Email us at businessdevelopment@firstaffirmative.com

Request a Demo

Our Business Development Team are ready to talk with you about our AffirmativESG platform and exactly how it will help you direct your clients wealth to the impact areas that matter most.

You can connect with us to schedule a demo in a variety of ways. Ready to schedule now? Please click the Schedule button below to immediately create an appointment. You are also able to email us directly or complete the Request a Demo form and we will reach out to you.