Overview – COVID Continues to Dominate

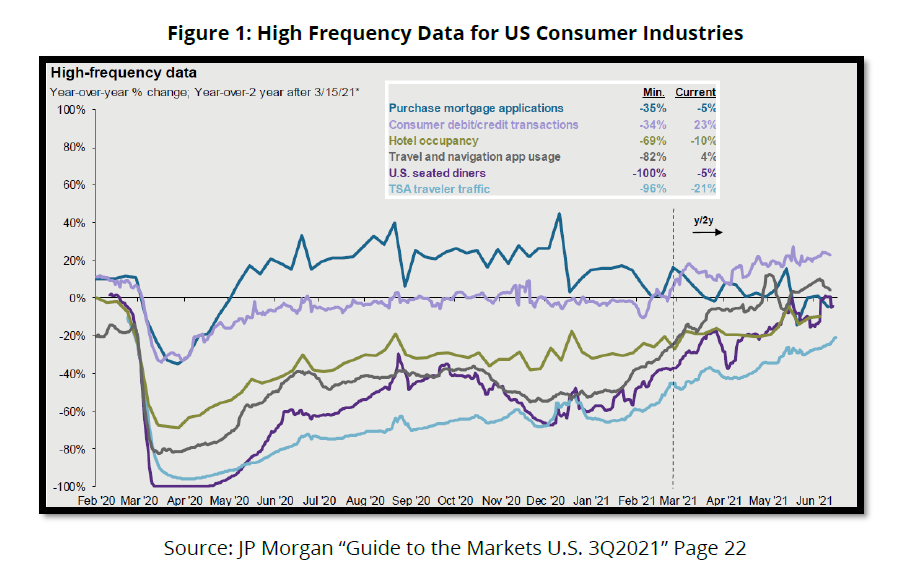

COVID-19 remains the greatest threat to economic stability. This is due, in part, to the many dislocations COVID-19 has created socially and across the economy. Economic activity is returning to pre-pandemic levels across many sectors. As shown in the graph below, many US industries show positive, albeit volatile, trends towards pre-pandemic levels of demand.

Although relative normalcy is returning to the US from an economic perspective, recovery outside the US is mixed. Even within countries, different regions and demographics are currently affected so differently by the pandemic that crossing a border can feel like traveling to another planet. Some areas have declared victory over the virus; some continue to impose restrictions on citizens in ongoing containment efforts; and others fight to mitigate the worst possible outcomes of devastating new strains. This has created very different economic environments worldwide.

Monetary policy decisions related to the pace of growth and recovery and supply and demand also vary dramatically by country and region. Government efforts to combat the economic turmoil caused by the pandemic have created a massive rift among countries’ economic recoveries;

countries with more economic resources available to them are able to do more to combat both the virus and the economic strife caused by the pandemic, leading to rapid recoveries in some countries (the United States), while others (India, Brazil, Indonesia) continue to suffer the crisis’ full effects.

In a globally connected world, greatly varied economic climates and paces of reopening have created supply-chain challenges as demand has returned to pre-pandemic levels, causing price increases across many industries. As a result, government fueled increases in demand is too great for pandemic- stymied supply chains. This supply-demand mismatch is among the key drivers of the current rapid rise in inflation. Combined with pandemic-subsidized unemployment benefits, rising prices have made many workers reluctant to return to low-wage jobs, including many in service industries. If the number of cases remains stable to down, over the next several months, many COVID-related divergences will begin to reconverge, and the global economic activity will move towards normalcy. Of course, this is critically dependent on rising vaccination rates, which will allow all nations to move in the direction of their pre-pandemic status quo.

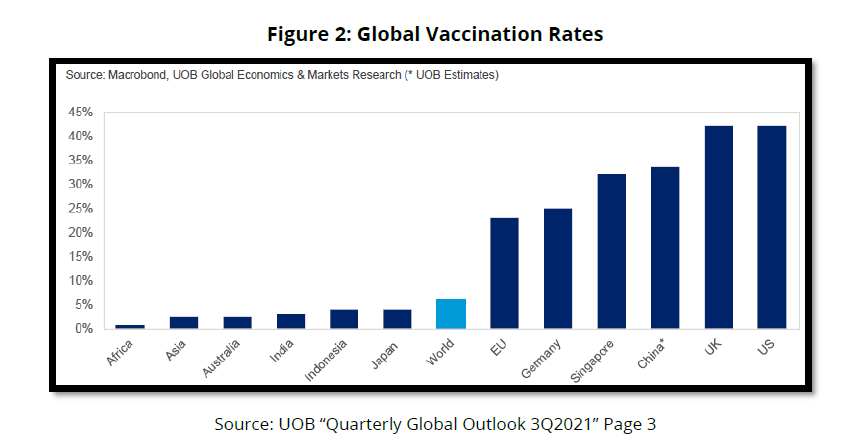

Vaccination rates can be affected by a multitude of local and international factors, be they political, logistical, or financial, creating difficulties for many countries in their pursuit of vaccination saturation. A country’s level of development also greatly contributes to efficient vaccination distribution, which means emerging markets are having more difficulty vaccinating their populations, compared with developed countries. This can be seen Figure 2, which shows the stark difference in vaccination rates between developed and developing nations.

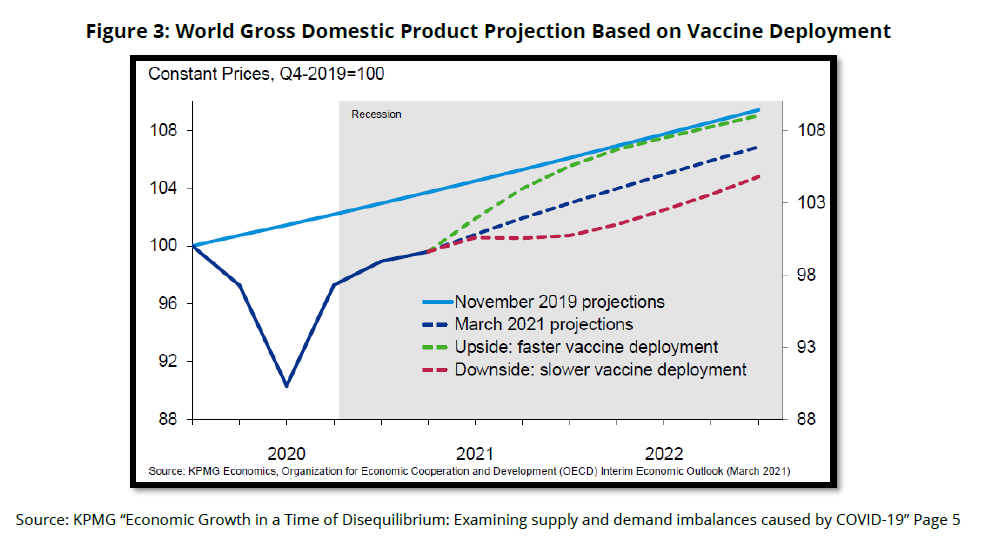

For the foreseeable future, a nation’s GDP growth will be directly correlated with its vaccine deployment rate. GDP will accelerate more quickly if vaccine deployment is handled expeditiously within a nation; nations will experience slower GDP growth should vaccine deployment rates be low or their growth rates stagnate. This is demonstrated in Figure 3, titled “World Gross Domestic Product Projection Based on Vaccine Deployment”, which shows three possible trajectories for world GDP’s return to normalcy as a function of vaccine deployment speed. Normalcy’s return will be drastically slowed should global vaccination rate face obstruction.

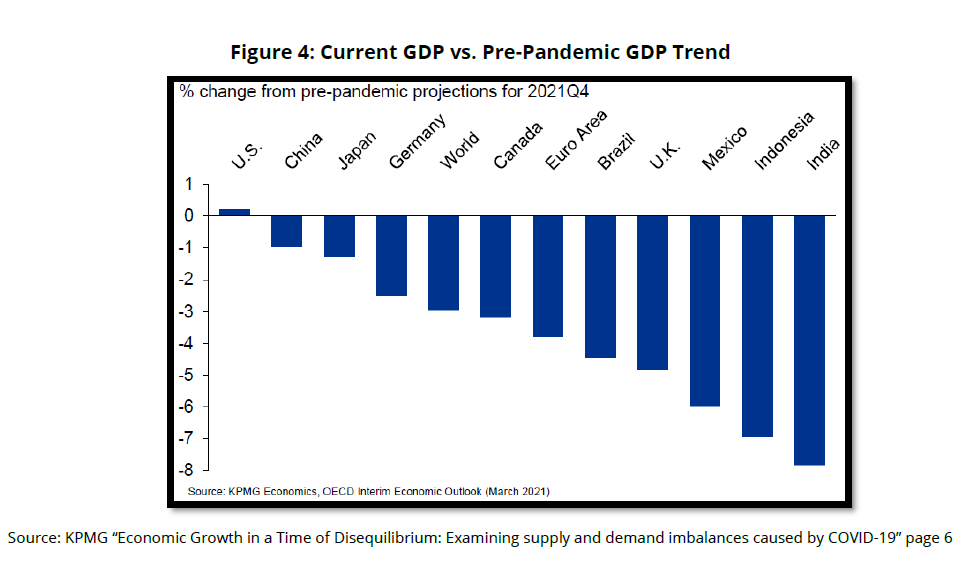

As illustrated in Figure 4, titled “GDP vs. Pre-Pandemic Trend”, the United States currently leads the pack in return to pre-pandemic GDP levels, closely followed by China, Japan, and Germany, while countries with low vaccination rates like Mexico, Indonesia, and India are experiencing a slower return to economic normalcy. China seems to be one of the only emerging markets experiencing a quick economic recovery. Japan is another outlier: It is a leader in economic recovery, despite a vaccination rate of less than 5 per 100 people.

The stark differences in economic recovery rates harken back to the issue of divergences caused by COVID-19, bringing some of these glaring gaps in recovery rates into the spotlight. Developed countries are recovering and consuming at pre-pandemic levels while developing countries – many developed country’s usual suppliers – are still trying to procure vaccinations and medical supplies; this is the source of the massive dislocations in supply chains right now.

Main Risk – The Rush to Normalcy Waylaid

- The resynchronization of global growth will be slowed by region-specific issues. These issues include COVID-19 related struggles, climate change, and politics.

- Regional divergences will continue to contribute to supply chains’ issues. Developing markets may continue to recover slowly. This reflects political discourse, geographical region, and medical, and financial resource availability.

- The speedy recoveries in developed markets have caused the demand for many goods and services to return rapidly to pre-pandemic levels.

- Differing recovery rates are causing prices of goods to skyrocket. Slow recoveries in many developing markets, coupled with the fast recoveries of many developed nations, have created decrease in supply of many goods.

- In many industries, the rapid return to pre-pandemic demand has not been met by a workforce eager to return to work. Labor shortages are fueling wage inflation.

Looking Ahead – Domestic Recovery Before Global Recovery

- US GDP is on course to recover to pre-pandemic levels faster than any other country.

- Economic and social dislocations created by COVID-19 will begin to shrink as vaccination rates increase, offering hope for a return to pre-pandemic levels, first in developed countries, then in emerging countries.

Emerging markets will struggle to recover as quickly as developed markets due to lack of resources, both financial and medical. This will likely slow the convergence of supply to pre-pandemic levels. Globalization will not stop, despite this, as all countries will be trying to move toward full-vaccination and normalcy. The question is not if the many gaps created by COVID-19 will begin to close, but how fast they will close. The global economy is continuing its journey through the winding tunnel of this pandemic. We know there is light at the end and can even start to feel the warmth of a post-pandemic sun on our faces now as the US leads the world into the light.