Companies Feel the Heat from Record Support for ESG proposals

Proxy season 2021 is winding down, most of the votes have been tallied, and First Affirmative is celebrating along with other activist investors — the outcomes are remarkable and record-setting.

Highlights from Proxy Preview as of June 24 tell the story:

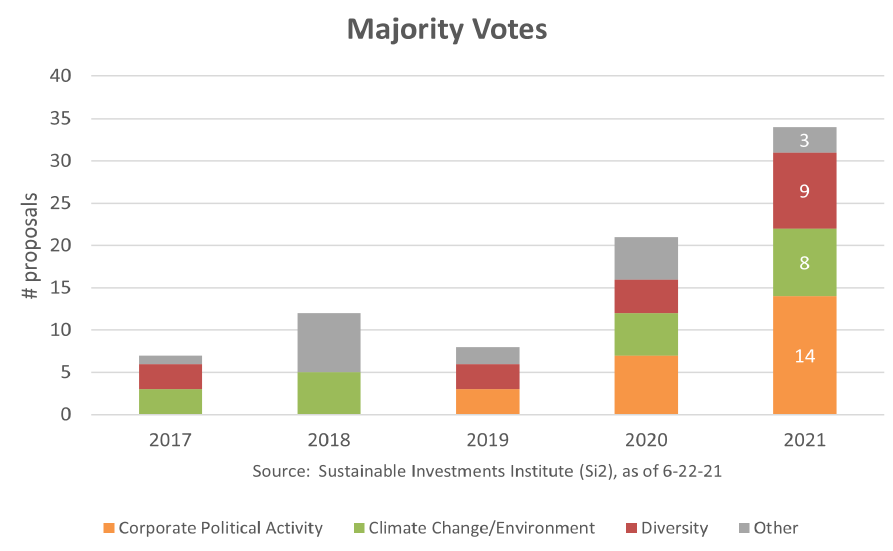

“To date, there have been 34 majority votes for ESG proposals, shattering last year’s record of 21. More are likely by year’s end. Last year, only two votes broke 70%, while this year 17 did. Eight were in the 80s and six saw more than 90% support. Four of the six that received more than 90% were supported by management — a first for U.S. environmental and social resolutions. More importantly, other high- scoring proposals were opposed by management but still earned huge support.”

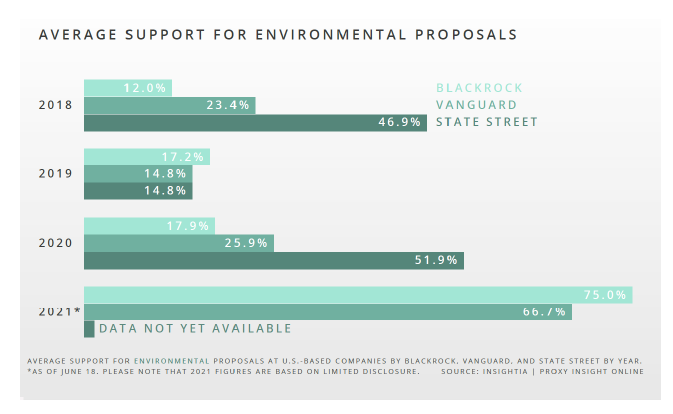

Strong support was seen on shareholder proposals addressing a broad spectrum of issues, including political spending, climate and environment, diversity, Covid- 19, sexual harassment, and racial justice. Environmental proposals received a strong boost from mainstream institutional investors, with majors like Blackrock, Vanguard and State Street voting records showing strong increases in support on these issues. This change in direction is welcome, if long overdue and with much room for continued improvement.

There was also a significant change in voting patterns on “say on pay” proposals. Although First Affirmative proxy voting guidelines lead us to routinely vote against over 60% of executive compensation packages, the overall average for votes against excessive compensation has been less than 2 percent. In 2021 support more than doubled, with 4.7 percent of proposed pay packages among S&P 500 companies failing in 2021 so far, up from 2 percent last year and 1.5 percent in 2019, according to ISS. A common reason for shareholder rejection of pay packages was inappropriate action taken by boards to “move the goal posts” for performance-based payouts, thereby protecting already extremely well-paid executives from Covid related underperformance.

And that’s not all-the financial community was staggered by the success of a tiny hedge fund, Engine One, in unseating three Exxon board candidates, with their own nominated candidates winning majority support. These candidates were put on the ballot primarily to push Exxon to finally address their role in climate change — and to transition their business model to a clean energy future. This outcome should put other companies on notice that the days of large institutional investors rubberstamping their board of director choices may be over.

The timing of this change in voting behavior by the broader investment community could not happen at a better time to support badly needed public policy changes:

- The SEC is pursuing the development of mandatory ESG disclosures from all publicly traded companies, and First Affirmative submitted a letter in support during a comment period soliciting public input.

- The House of Representatives passed legislation requiring companies to disclose ESG metrics. While unlikely to pass the Senate, this action provides support for strong SEC action.

- Controversial SEC rules passed last year that make it more difficult for investors to file shareholder proposals, and take affect for the next proxy season, have been challenged with a lawsuit filed by a coalition of shareholder proponents. We can hope that the stark contradiction between the escalating support for disclosure of ESG information and the adverse impacts the rule will have on investor attempts to solicit such information will lead to a suspension of the new rules while the issue is decided in court.

Engagement Briefs

Sick Leave. We wrote letters to 15 of our consumer facing portfolio companies whose public disclosures are not adequate for investors to assess corporate sick leave policies.

Although many companies have established much needed policies to provide paid sick leave to employees impacted by COVID-19, a review conducted by Corporate Knights indicates that only 18% of companies headquartered in the United States offered sufficient permanent paid sick leave — and frontline, low-wage, part-time employees are the least likely to have paid leave at all.

To date we have received responses from over half of the companies and held productive dialogue with three of them. Unfortunately, the SEC blocked our shareholder proposal co-filed with Zevin Asset Management at Kroger asking that they consider making sick leave policies established during the pandemic permanent, citing the “ordinary business” exclusion. This limits our ability to make progress with nonresponsive or lagging companies. We are participating in efforts through the Shareholder Rights Group asking the SEC to “reset” their decision-making process to allow proposals that address a significant policy issue that are of widespread controversy or involving potential for significant impact on the environment and society to transcend ordinary business.

Public Policy. With generally more receptive audiences at the federal and state level, we are actively supporting bold climate action and social policy that supports a just and sustainable society and economy. This has included lending investor support to renewing the renewable energy tax credit, providing permanent protection for Bristol Bay in Alaska, and supporting restoration of methane emissions reduction rules.

In our home state of Colorado, we actively supported the Colorado Transportation Funding Bill that provides $730 million toward EV programs, representing one of the biggest investments in transportation electrification by any state in the country. We are pleased to report that it has passed the General Assembly and been signed into law.

We also supported the California Climate Risk Disclosure bill. CERES, the organizer of this effort, subsequently was notified that Senate President Pro Tempore Toni Atkins moved to a support position on SB 449 after seeing the investor support letter and noted that “being able to draw a direct line between your support and a Senate leader’s change in position is a big deal and demonstrates the impact of your engagement with this bill.”

Climate. We participated in an investor drive to request companies to report environmental data via the CDP reporting platform, as it provides consistent and comparable data required to assess climate action by companies. We led a 45 institutional investor coalition in a request to Caterpillar and signed on to 18 additional requests. We also had encouraging discussions with Tractor Supply and ADP to encourage rapid adoption of renewable energy strategies. Also, read about our hosting of two portfolio companies so that a corporate leader in renewable energy adoption could share valuable information with another company just beginning their integration of renewable energy in our recent blog. A snapshot of the final outcomes of shareholder proposals filed in 2021 is available on our website.