By Holly Testa | Download the PDF

Proxy Voting Trends

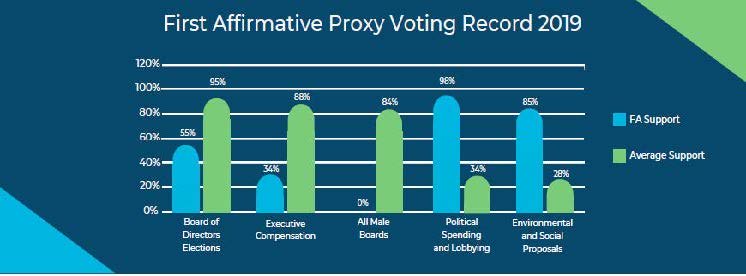

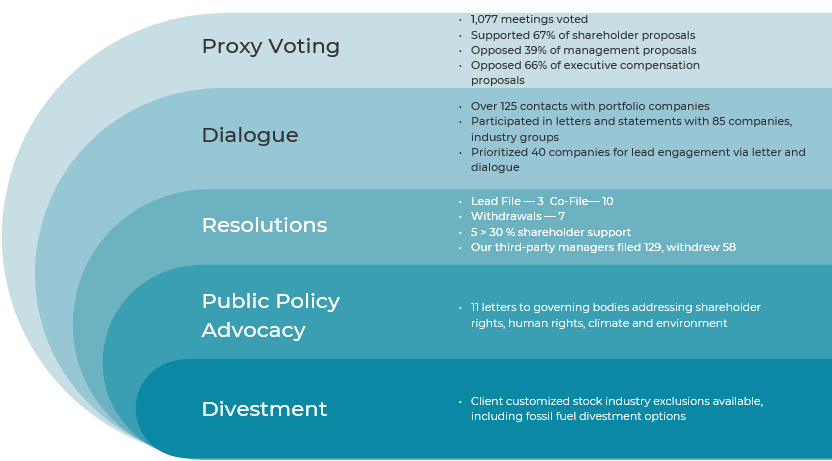

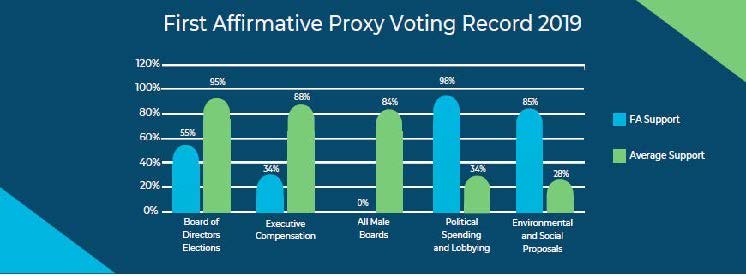

Our track record on proxy voting continues to contrast sharply with overall averages, as our proxy voting guidelines establish standards not typical within the mainstream investment community. We voted against over 40% of nominating committee board members due to lack of gender and racial diversity and against almost 50% of compensation committee board members due to their oversight and approval of excessive executive compensation.

Support for environmental and social proposals dropped from 27% in 2018 to 25% in 2019. This reflects in part the failure of the largest institutional investors like BlackRock and to J.P. Morgan Chase to support proposals that address critical ESG issues. This is in spite of their commitment to better align proxy voting with their public commitment to ESG investing and engagement following shareholder proposals in 2017. Concerned investors are re-engaging with these institutional managers by filing shareholder proposals again in 2019.

Proxy Season 2019

2019 Shareholder Resolutions

Integrating the Sustainable Development Goals

Engagement Briefs

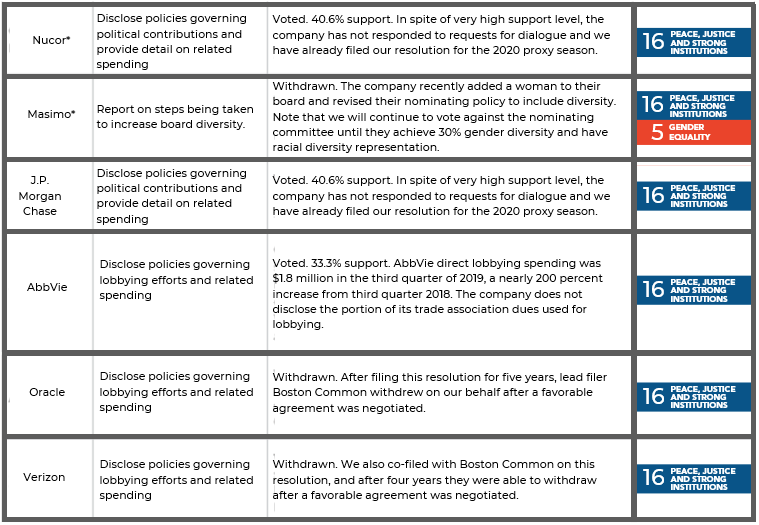

Climate and environment

We continue to engage the dwindling number of companies in our portfolio that don’t provide sustainability reporting, and were able to withdraw a proposal at SBA Communications after dialogue. We continued our ongoing letter writing campaign, contacting six companies asking for action on sustainability reporting and three companies requesting disclosure about their plans for renewable energy adoption. We signed on to over 75 letters and statements to individual companies requesting specific climate and environmental disclosures and action, including setting science-based targets for greenhouse gas emissions, the management of animal protein sourcing, and ceasing the export of and reducing production of plastic waste. We also participate in in the Investor Decarbonization Initiative, an investor coalition established by Share Action that has helped investors engage with companies to make significant progress in getting companies to commit to proactive emissions reductions.

Diversity

Our work on board diversity continues, and we were able withdraw proposals at Masimo and Cambrex following productive dialogue. We are pleased that Masimo is now removed from the ranks of companies with no gender diversity, but nominating committee members will still earn a no vote until gender diversity reaches 30% and racial diversity is achieved. Support for all male boards continues to erode, dropping from 88% to 84% as more major institutional investors amend their policies to vote against nominating committee members. This was a watershed year, in that the S&P 500 has no all-male boards left and boards with three or more women climbed from 37% in 2016 to 56% in 2019.

Political spending

Our lead file at Nucor asking for political spending disclosure garnered a strong 40.6 support and a lobbying proposal at AbbVie achieved 33.3% support. Three lobbying proposals were successfully withdrawn.

Public Policy

While the ongoing threat to shareholder rights dominates our work on public policy, we also weighed in on other issues that are state, national and international scope. We supported reporting requirements to minimize corporate tax avoidance and encouraged the Financial Accounting Standards Board to require country by country reporting of tax payments. We also joined the We Are Still In Campaign pressing the new Congress to take climate action. We petitioned the Bangladesh government to allow the Accord on Fire and Building Safety to effectively continue its work to improve working conditions in the garment industry. An agreement was reached with the Bangladesh government.

In our home state of Colorado, we contacted legislators on three separate occasions to support aggressive GHG emissions goals and electrical vehicle support via extension of the vehicle credit and funding for charging infrastructure. Upon successful passage of these initiatives, our CEO George Gay noted that “As the rest of the world shifts toward electric transportation, forward-looking policies like a strong ZEV program provide companies and investors with the policy certainty needed to enable long-term investments in this rapidly growing industry, spur innovation, and generate more local jobs for Colorado’s residents.”

Our Focus on Financial Institutions: Investing for the Future or Bankrolling Failure?

We have engaged in two campaigns focused on financial institutions in recent years addressing 1) the failure of financial institutions to adequately address climate change in their lending and investment portfolios and 2) the role of banks and credit card companies in financing firearms purchases. (learn more about our firearms campaign here).

Why concentrate on financial institutions? They collectively act as gatekeepers to capital via their lending and investment decisions-and how they make those decisions will be a major determinant of the nature, pace, and scale of collective action on a broad range of long-term ESG issues. Nowhere is this more apparent than fossil fuel financing, as Bill McKibben points out in Putting Pressure on the Finance World Could Be One of the Most Effective Ways to Fight Climate Change. Our client portfolios are also indirectly exposed to industries otherwise excluded from their portfolios via these institutions lending and investment decisions.

Case Study: J.P. Morgan Chase

First Affirmative led an 82 investor coalition representing over $176 billion in assets under management in sending a letter to open a discussion about J.P. Morgan Chase’s regrettable position as the leading financer of the fossil fuel sector.

All banks, including JPMorgan Chase, are crucial to accomplishing the necessary transition from a fossil fuel to a renewable energy-based economy, through the rapid redeployment of the capital required to meet the goals of the Paris Agreement. J.P. Morgan has touted its sustainable practices with substantial commitments to clean energy, vowing to facilitate 200 billion in clean financing by 2025 and committing to 100% renewable energy by 2020. However, these commitments seem insignificant when reviewing the companies lending practices. A recent report on global banks’ financing of the fossil fuel industry, Banking on Climate Change, found that since the Paris Agreement was adopted J.P. Morgan Chase has been the world’s biggest banker of fossil fuels overall, with financing of $196 billion, nearly 30% higher than the #2 bank. It is also, by far, the #1 banker of the 100 top companies expanding fossil fuel extraction and infrastructure.

Policies aligned with the Paris Agreement should recognize that fossil fuel extraction and use must be rapidly ramped down, and therefore must contain appropriate financing restrictions, particularly on financing that facilitates the development of new reserves. Recent dialogue with the company provided insights into ongoing risk analysis for high carbon sectors, with promises of more explicit disclosure in the near future, but this is not enough. All banks need to assess their role in contributing to the climate crisis and change course. First Affirmative joined As You Sow and other investors to file resolutions at J.P. Morgan and other banks asking them to immediately take tangible steps to measure, disclose, and reduce the GHG associated with fossil fuel lending.

In Their Own Words: Advocacy Accomplishments of Our Activist Managers

When First Affirmative builds investment portfolios designed to align with client values and financial goals, we engage investment managers who actively engage with portfolio companies on crucial ESG issues. We often partner with these managers on advocacy initiatives, which enhances our negotiating hand when negotiating with companies. We asked some of these leading firms to share impactful moments from 2019. Learn more about all of our activist managers by clicking on the manager icons.

Our Activist Managers

Advocacy Partners

First Affirmative joins forces with non-profit organizations that support investor networks addressing sustainability issues through active ownership and corporate engagement. Each of these organizations provides specialized expertise that supports our corporate engagement on priority issues. Our primary advocacy partners:

The Fight for Shareholder Rights

Our October 2019 newsletter highlighted the threat posed by recent actions by the Securities and Exchange Commission (SEC), including a proposed rulemaking at the SEC that has since been published. In addition to substantial changes in the filing thresholds and resubmission thresholds for shareholder proposals, the proposed rules would curtail our ability to effectively represent our clients. Here are the key elements and potential impacts on our clients and advocacy program:

Shareholding requirement

- Now: $2, 000 held for one year, aggregation of shares allowed

- Proposed: Increases to holding size of $25,000 for one year, $15,000 for two years, $2,000 for three years, aggregation of shares not allowed

Impacts: This increase arbitrarily disenfranchises clients with smaller holdings . Our largest clients often meet the proposed thresholds, but most clients have holdings that would not meet first and second-year thresholds. In 2019, NONE of the resolutions we filed could have been filed on behalf of those clients until year three. Aggregation, which allows shareholders to combine shares to meet the holding requirement, would be disallowed.

The ability to file a resolution provides leverage in those cases where a company is not effectively addressing material ESG concerns. Without that leverage, our ability to engage with reluctant companies will be adversely impacted.

Support required for proposal resubmission

- Now: 3% first year submitted /6% second year/10% third year

- Proposed: 5% first year submitted/15% second year submitted/25% third year submitted AND proposals that after 3 years receive >25% but < 50% and support declined by 10% will be excluded.

Impacts: Most proposals filed by First Affirmative that have gone to a vote exceed proposed thresholds, but this rulemaking is particularly damaging to shareholder’s ability to raise concerns about emerging issues and eliminates the opportunity of shareholders to use their proxy to weigh in on important issues. Most proposals start with minimal support, but those that prove their business case over time are often withdrawn after successful negotiation — or go on to win substantial, and even majority support.

For example, a proposal to granting investors the right to nominate board directors to appear on the proxy received only 4.4% support the first year it was filed at Netflix, but won a majority vote when refiled two years later in 2015. The Board enacted proxy access in 2019. The same patterns applied at other companies on this same issue before achieving majority support and eventual company adoption.

The Fine Print

The proposed rule also requires for shareholder proponents to state when they would be able to meet with the company to discuss the proposal. A similar requirement is not imposed on the company. More concerning yet, the provision with the greatest adverse impact to our advocacy program is tucked away in a short footnote. Our clients routinely delegate the proposal filing and subsequent negotiations to First Affirmative. Footnote number 70 simply states that the filing shareholder (a.k.a. our client!) is required to be present during these negotiations as well.

We are greatly concerned that the SEC would choose to interfere with the advisor/ client relationship in this way. Our clients retain us to provide them investment advice; they should certainly have the right to delegate complex discussions on material ESG issues that impact the investments that we manage.

60 Day Public Comment Period Ends February 3, 2020

SEC Chairman Clayton cited numerous supporting letters reported to be from “mainstream investors” as evidence of investor support when he announced proposed rulemaking. Those letters are now the subject of an investigation as to their authenticity, with Bloomberg reporting that their investigation “… shows they are the product of a misleading — and laughably clumsy — public relations campaign by corporate interests.”

We are heartened to see that a large and diverse array of investors have joined First Affirmative to submit critical comments in the last few weeks — from large financial industry groups representing the SRI/ESG community, institutional investors, foundations and individuals. Our advisors and clients are also weighing in through personalized letters and petitions.

Regardless of the final SEC decision on this issue, First Affirmative remains committed to a strong and vibrant corporate engagement program.

The opinions and concepts presented are based on data believed to be reliable; however, no assurance can be made as to their accuracy. Mention of a specific company or security is not a recommendation to buy or sell that security. Past performance is never a guarantee of future results. For information regarding the suitability of any investment for your portfolio, please contact your financial advisor.

The views expressed herein are those of First Affirmative and may not be consistent with the views of individual investment advisors or Broker-Dealers or RIA firms doing business with First Affirmative. Network Advisors may offer securities through various Broker-Dealers and Registered Investment Advisory firms.

These affiliations, and all fees charged to clients, are clearly disclosed. First Affirmative’s ADV Disclosure Brochure is available any time. Please write or call for a copy, or visit firstaffirmative.com/about/.