By Holly Testa | Download the PDF

The traumatic impacts of the ongoing COVID- 19 outbreak are necessarily focusing attention to immediate concerns at the expense of just about everything else. Some thoughts on the challenges and opportunities we see as we navigate the changing day-to-day landscape:

Our Work Continues

The COVID-19 crisis will do much to shape our agenda going forward, but we continue to focus on long-term systemic issues even as we re-focus our short-term strategy. We had already filed 11 shareholder proposals on behalf of clients for the 2020 proxy season prior to the onset of COVID-19, taking leadership on two resolutions.

- Nucor – We refiled our proposal asking for a report on political spending policies and practices. This proposal was well received by shareholders in 2019, garnering over 40% in support. Political spending and lobbying policies and practices have long been priority issues for us. They will continue to be as dollars pour into lobbying efforts by corporations and industry groups, looking to shape government funding and policy responses to COVID-19, that have potent implications for climate action and human rights.

- Capri Holdings – We filed a proposal asking for annual sustainability reporting after a multi-year engagement effort. Capri is the holding company for Michael Kors and Versace, and is in the regrettable minority of companies in our client portfolios that lack sustainability reporting. We are now in promising dialogue with the company.

We Can Report Successful Withdrawals

- YUM Brands has made significant commitments to reduce plastic packaging waste. A similar proposal we co- filed last year with lead filer As You Sow achieved over 30%of the vote, and the agreement achieved to phase out polystyrene packaging is the result of a multiyear engagement effort.

- Morgan Stanley agreed to analyze methods to measure its portfolios for alignment with the Paris Agreement.

- In contrast, J.P. Morgan attempted to avoid a vote on a similar proposal by challenging it at the SEC. Fortunately, the SEC sided with shareholders and the proposal will go to a vote. The latest report from the Rain Forest Action Network reveals that J.P. Morgan continues to be, by far, the largest lender to fossil fuel interests in the world. We co-filed this resolution following JP Morgan’s inadequate response to a letter we sent on behalf of an 82 member investor coalition requesting that the bank measure and reduce the carbon footprint of its lending portfolio. To learn more, read our recent case study.

With large gatherings out of the question for the foreseeable future, the SEC issued a bulletin offering guidance to companies with regard to holding virtual meetings. We fully support the adoption of virtual only meetings in the short- term. However, we urge all public companies to ensure that their virtual meeting plans maintain all of the rights and privileges that come with share ownership, as outlined in this investor statement issued by the Shareholder Rights Group, which we supported as a member.

Some avenues of outreach to companies have been necessarily curtailed, but portfolio companies are still engaging and improving ESG performance. For example, baby clothing manufacturer Carter’s just published their first sustainability report. We are pleased that it addresses many of the concerns we discussed with them late last year.

Critical Advocacy Issues Come into Focus with Crisis

Deforestation has been a priority issue as a known driver of climate change, environmental damage, and human rights abuses. The emergence of COVID-19 highlights the urgent human health and economic risks we are taking as deforestation and other human disruptions to ecosystems escalate the emergence of zoonotic diseases.

The inadequacies of governance policies and practices at some companies also became readily apparent during this abrupt transition from “business as usual” to shocking disruption. The consequences of focusing on short-term gains at the expense of long-term performance and resilience are glaringly apparent in real time:

- Corporate sick leave and employee health coverage policies. Companies may enhance their bottom line in the short term by not providing sick leave and health insurance benefits to employees. However, the tremendous economic and social cost with which we are now reckoning as a result of this single pandemic will far surpass those shortsighted savings. It is encouraging to see companies committing to sick leave and covering lost wages during this crisis, and yet companies like McDonald’s and trade associations representing corporate interests continue to lobby against paid sick leave at both the state and federal level.

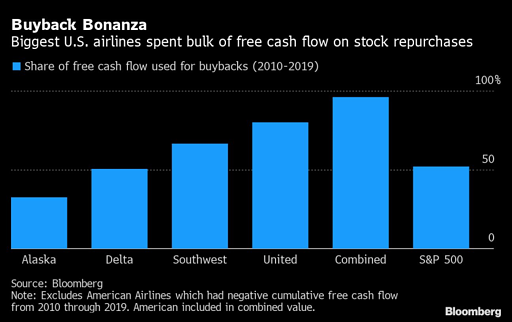

- Share buybacks instead of investing in the future – or saving for a rainy day. In 1982, share buybacks-the ability for companies to re-acquire their own shares, became legal. Companies eagerly embraced this tool that allowed them to return dollars to participating shareholders, including senior executives, of these companies. Stock buybacks can be a good tool to return dollars back to shareholders if company stock is undervalued and there are not more compelling investment options, but as Warren Buffet points out, “Blindly buying an overpriced stock is value-destructive, a fact lost on many promotional or ever-optimistic CEOs.” Buybacks enhance stock price in the short run, but they also reduce cash available to invest in employees, research and development — and managing a crisis.

Case in point: The airline industry spent 96% of its free cash flow on buybacks in the past decade while heavily in debt and while their stocks were, in hindsight, overvalued. That money is no longer available to weather this crisis, and with stock prices plummeting, it is no longer in the pockets of long-term shareholders either.

Companies who went into this crisis with a significant cash cushion are much better positioned to survive…and thrive.

Implications for Climate Action

Covid-19 lays bare the consequences of delay in the face of compelling evidence. Even as COVID-19 diverts attention from climate action, it clearly demonstrates the increasing risk we are taking in not acting aggressively to curb the human impacts on climate in the face of similarly compelling evidence.

The actions taken to contain the virus are reducing greenhouse gas emissions in the short term far more than any initiative ever launched to reduce carbon emissions. China’s emissions are estimated to have been reduced by at least 25%, and as each country acts to contain the outbreak this type of reduction will ripple throughout the economy. A recent analysis of the corresponding drop in particulate matter in China, by Stanford University scientist Marshall Burke, indicates that “Even under more conservative assumptions, the lives saved due to the pollution reductions are roughly 20x the number of lives that have been directly lost to the virus.”

While the rapid and steep drop in carbon emissions and subsequent lives saved is a compelling illustration of what the future could look like, it also highlights just how far we have to go in decoupling economic growth from fossil fuel emissions.

Crisis events serve as turning points. We can either contain this crisis and return to an unsustainable “business as usual” model that will lead us to the next inevitable crisis — or we can finally address the systemic issues that threaten our way of life and create a sustainable, vibrant, resilient economy.

We will continue to strive for the latter on behalf of our clients.