Record Archived

By Mel Miller, CFA®, Chief Economist|Download PDF

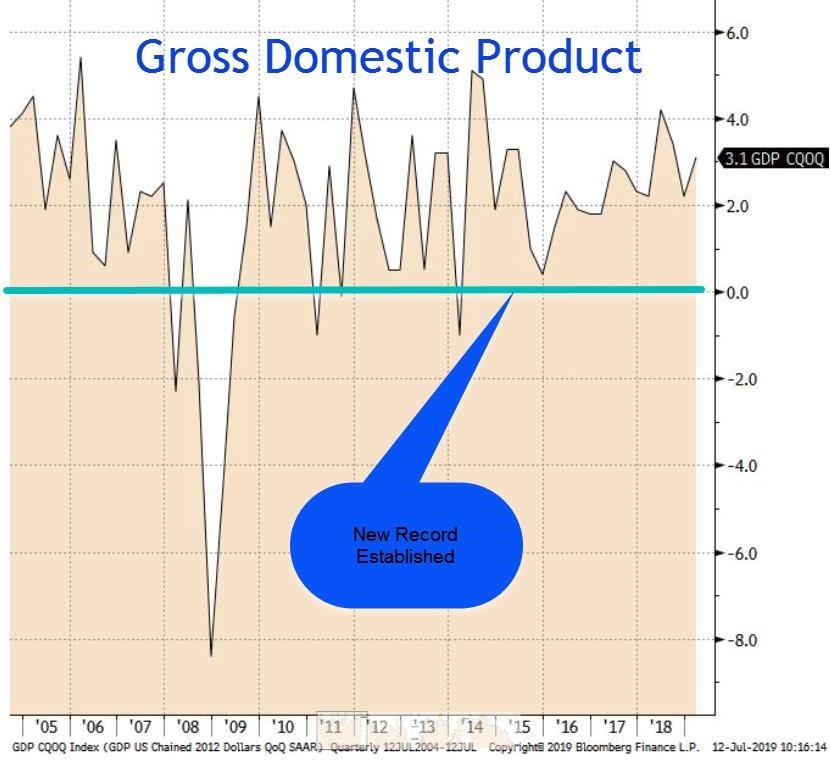

The US economy enters July having achieved the longest economic expansion in history. The economy reversed the contraction that began in July of 2004, starting at the end of the second quarter of 2009. Many have criticized the slow pace of the recovery, but having positive quarterly growth for 40 straight quarters is quite an accomplishment no matter the speed. Even more surprising during the record-breaking expansion is the contained inflation rate, which averaged 1.6%. Even after ten years, today’s annual inflation rate is only 1.8%. WOW!

The question I receive the most is “Since the economy has never expanded more than ten straight years, doesn’t that mean the expansion is about to end?” My answer is, “Why?” There is nothing sacred about ten years. Past expansions were thwarted in most cases by an over-aggressive Fed Reserve concerned over rising inflation. The illusionary “soft landing” was often not the result of the rate increases, but a recession was. Driven by government-sponsored immigration, Australia is in the twenty-eighth year of economic expansion. Granted that card is not even in the deck of the current administration.

Since the expansion is not time-bound, will the economy continue to expand? Has the economy slowed in the second quarter? Will the first quarter growth of 3.1% exceed the second quarter? Have the odds of a recession in the next twelve months increased? I will address all of these crucial questions.

First, an examination of the first quarter is needed. I anticipated a slowing in the first quarter as a result of the tariff skirmish policy of the current administration. At first, I was shocked as the economy expanded 3.1% while I was only anticipating growth of 1.25%-1.75%. The factor I missed was the reaction of US producers concerned over the threatened increase of Chinese tariffs from 10% to 25%. In anticipation of the March (since then moved to October) increase in tariffs, businesses increased inventory accumulation.

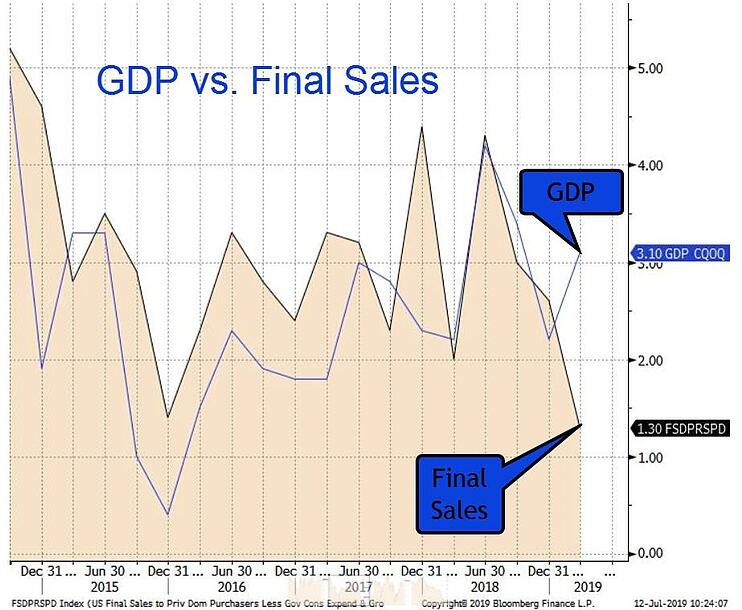

The Fed is utilizing the final sales to US consumers to measure the strength of the economy. The Final Sales Index computed by the Bureau of Economic Analysis eliminates the inventory impact. Usually, the index tracks with the GDP measurer but not in the first quarter. GDP rose a healthy 3.1% without inventory accumulation. Final Sales rose a mere 1.3%. GDP and Final Sales. Final sales dropped from a 2.6% quarterly rate during the fourth quarter of 2018 to 1.3% during the first quarter — a significantly different picture than the touted 3.1% GDP growth.

President Trump sent shockwaves through the nation when on March 29th, he threatened to close the Mexico/US border to stop illegal immigration. As a result of bi-partisan pressure, he reversed his position on April 4th and gave Mexico a year to comply.

May 30th saw a continuation of economic bullying as President Trump threatened to impose a 5% tariff on all goods entering the US from Mexico on June 10. The duties were supposed to increase by 5% per month until reaching a maximum of 25% in October. As is his custom, he announced on June 8th an “agreement” for Mexico to impose policies to stop the migration of illegals through its land. UNCERTAINTY is a significant overhang facing the economy and is the primary foreign policy technique of the current administration.

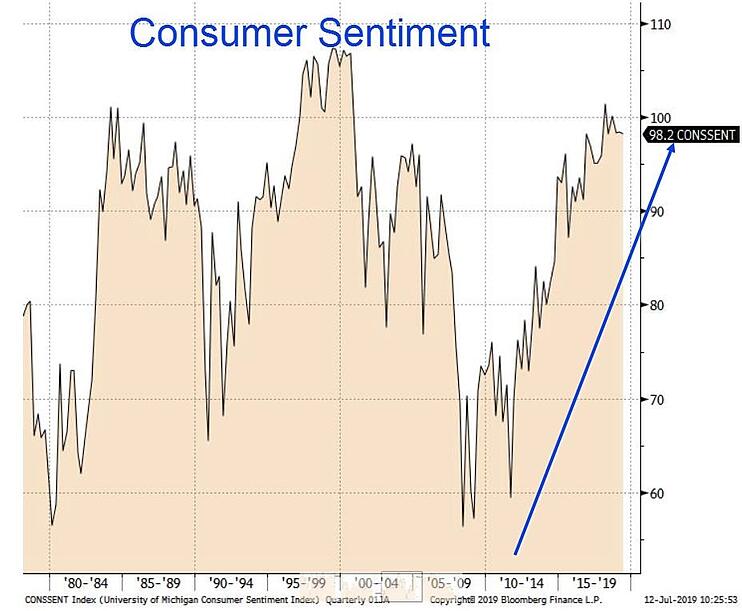

How has the all-important consumer dealt with the uncertainty? Consumer attitudes, as measured by the University of Michigan Consumer Sentiment Index, still reflects an optimistic consumer as the index remains near a record high. The current June reading of 97.9 is well above the average of 86.2 since the index started in 1952. Is the consumer still driving the economy through their purchases?

At the end of March, the year over year increase in retail sales was 3.8%, now the rate is 2.9%. There is the beginning of a disconnect between consumer sentiment and retail sales.

While the consumer will ultimately pay the cost of tariffs, the business community wrestles with disrupted supply chains. There is a manufacturing exodus from China as firms relocate to Vietnam, Malaysia, India, and Indonesia. This movement comes at a growing cost to the economy through dislocations and a lowering of efficiency.

The Federal Reserve, reacting to a slowing economy, reversed direction in the second quarter. During 2018 the Fed raised the Fed Funds rate four times, and as late as December 2018 the markets were anticipating three additional increases. As the trade “skirmish” evolved into a trade “war,” Chairman Powell stated his willingness to cut rates to avoid an economic slowdown. Look for a rate cut at their next meeting on July 31, 2019. The decline in the 10-year treasury yield from 2.6 % to a recent low of 1.9 % reflects market expectations of a coming rate cut.

I foresee the second quarter GDP slowing from the artificially inflated first quarter significantly. It is difficult to predict the extent to which inventory adjustment and supply chain realignment negatively impacted the economy. I forecast a second-quarter GDP of 1.75% to 2%. The key, as was the case of the first quarter, will be the US Final Sales to Private Domestic Purchasers. Elimination of inventory impact is the key in a trade “war” economy.

At mid-year, my recession predictors reflect a moderating economy. At the end of March, I raised the probability of a recession in the next twelve months to 35%. Given the continued slowdown, I feel the necessity to increase the odds to 40%. A recession is not time-bound; the expansion can continue, but headwinds as a result of the trade “war” could dash hopes. Another headwind on the horizon is the coming debt ceiling limit, which will be reached in September, earlier than expected because of slumping corporate tax revenue. The political drama could negatively impact the economy.

Mel Miller, CFA® is Chief Economist and a member of the First Affirmative Investment Committee. He monitors economic conditions and market movements, and keeps the firm and its network advisors current on economic issues.

NOTE: Indexes are not available for direct investment. Mention of a specific company or security is not a recommendation to buy or sell that security. Past performance is never a guarantee of future results.

Source of graphic data: Bloomberg