By Holly Testa | Download the PDF

Economic Overview

Below is our compilation of the economic views expressed by First Affirmative’s key data providers. You may click on the links provided in the footnotes to access the complete report.

“The COVID-19 shock altered the course of the global economy and ravaged financial markets, prompting policymakers to step in quickly and with scale. Unprecedented monetary and fiscal stimulus, combined with signs of an economic recovery as lockdowns eased, triggered a rapid rebound in risk assets.” (1)

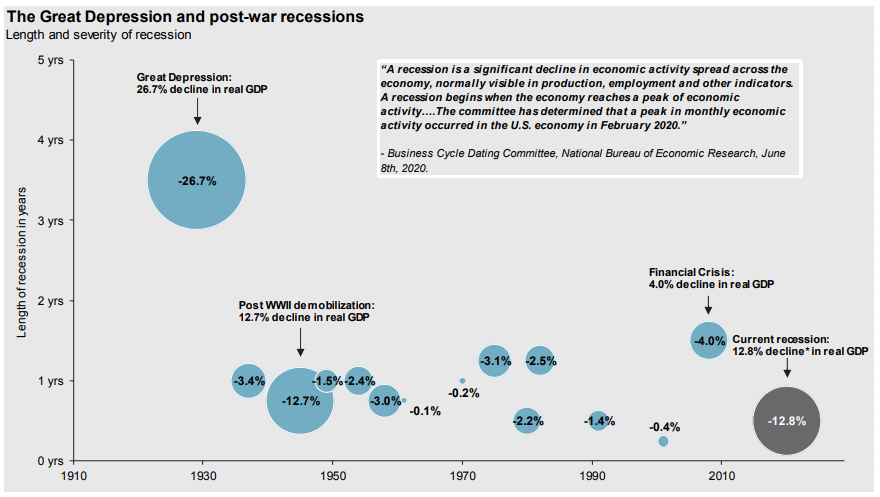

“The National Bureau of Economic Research declared the economic peak and end of the 11-year long record economic expansion as of February 2020. As investors try to size up the damage of this current recession, it is helpful to reflect on past recessions as a comparison. The x-axis shows the years in which a given recession occurred, the y-axis shows the length of a given recession and the bubble size represents the severity of a given recession. The severity is defined as the peak to trough decline in real GDP.” (3) – See chart below.

Chart Source: JP Morgan Asset Management

“After a historic contraction in real (inflation-adjusted) GDP of 30 percent in the second quarter at an annualized rate, PNC’s baseline forecast calls for economic growth well above its recent average in the second half of 2020 and throughout 2021. Even so, real GDP is not expected to return to its pre-recession level until the first half of 2022. Unemployment will be persistent, even with very large job gains; the unemployment rate will fall below 10 percent later this year, and end 2021 at above 6 percent and 2022 at above 5 percent. Inflation will remain consistently below the Federal Reserve’s 2 percent objective in the near term as businesses will have minimal pricing power due to excess capacity throughout the economy, allowing the fed funds rate to remain near zero into 2023.” (2)

Outlook

“The easily transmitted virus spread rapidly around the globe, infecting more than 6 million people. Although deaths and illness are certainly a tragedy, the biggest impact to global economies came from government-imposed lockdowns that shuttered businesses and curtailed consumer activity. As a result, we have slashed our growth forecasts over the past quarter, and they are now mostly below-consensus. Our base case outlook for the U.S. is for a 7.1% decline in 2020 GDP, though we recognize a variety of scenarios are possible based on the depth and duration of the shutdowns and the speed of the subsequent recovery.”

“Mandated lockdowns required governments to support workers who could not work and companies that were not allowed to operate. The fiscal stimulus provided has been massive and broad-based, spanning many countries and sectors, with provisions for households as well as businesses. In the U.S., the federal government delivered nearly US$3 trillion in financial aid, almost double the US$1.6 trillion doled out during the financial crisis of 2008-2009. The U.S. Federal Reserve also supplied substantial relief on the monetary side, slashing short-term interest rates by 150 basis points in early March, and expanding its balance sheet by trillions of dollars to ensure the proper functioning of financial markets. Together, the U.S. fiscal and monetary programs have so far amounted to more than 35% of GDP.”

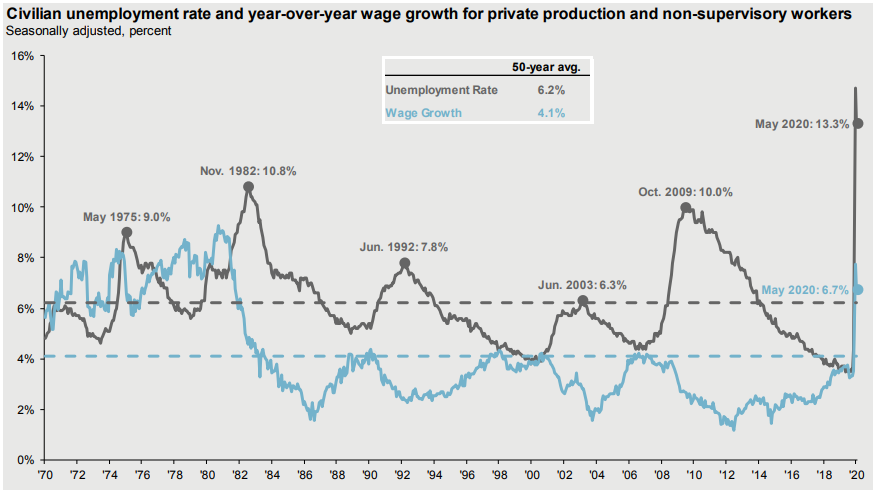

“The unemployment rate declined to a 50-year low in February at 3.5%, and has since risen into the teens, the highest since the Great Depression. Although the unemployment rate rose very swiftly, we do not anticipate the recovery will be nearly as speedy. The unemployment rate could remain in the double digits at the end of 2020, and in the high single digits by the end of 2021. Wages have risen since the start of the downturn, reflecting lower-wage earners losing their jobs, pushing up overall wages.”5 – See chart below.

Chart Source: JP Morgan Asset Management

1) RBC Article

2) PNC Article

3) JP Morgan Article