Back from the Abyss

By Theresa Gusman | To View PDF Click Here

April 19, 2021

Overview

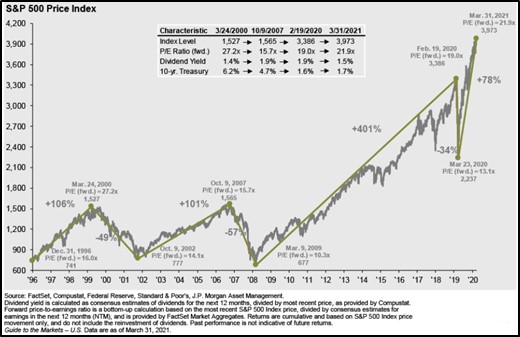

A year ago, we stared into the abyss. We wondered how bad the damage – economic, social, personal, and professional – would be. Now, although challenges remain, ongoing policy support and the quickening pace of vaccine distribution have created a sense of optimism. This rise in confidence has been reflected in equity markets, with the S&P 500 surging 78% through the end of the first quarter from its low on March 23, 2020 (see Figure 1).

As strong as the equity market rally has been, the ongoing rollout of COVID-19 vaccines, near-record corporate profit growth, abundant liquidity, and prospects for accelerating economic growth suggest that it could continue, despite record high valuations. Fixed income markets have not fared as well.

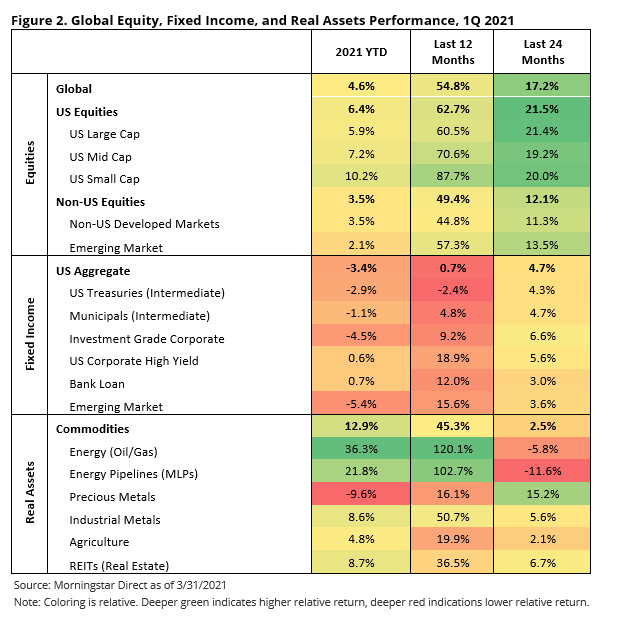

- Year to date through March 31st, US Treasuries (Intermediate) and the US Aggregate Bond indices fell 2.9% and 3.4%, respectively.

- US stocks resumed their dominance over non-US equities. However, for the second consecutive quarter, small- and mid-cap stocks outperformed large cap stocks, value outperformed growth, and energy and materials topped the leader board, with consumer staples and technology lagging.

Figure 1. S&P 500 at Inflection Points – Bull and Bear Markets, 1996 to Date

First Quarter Market Review

Accelerating economic activity and rising inflation expectations resulted a decline in bond prices, a slower – albeit still-strong – a increase in stock prices, and higher energy prices in the first quarter (see Figure 2).

Figure 2. Global Equity, Fixed Income, and Real Assets Performance, 1Q 2021

Note: Coloring is relative. Deeper green indicates higher relative return, deeper red indications lower relative return.

Equity Market Update

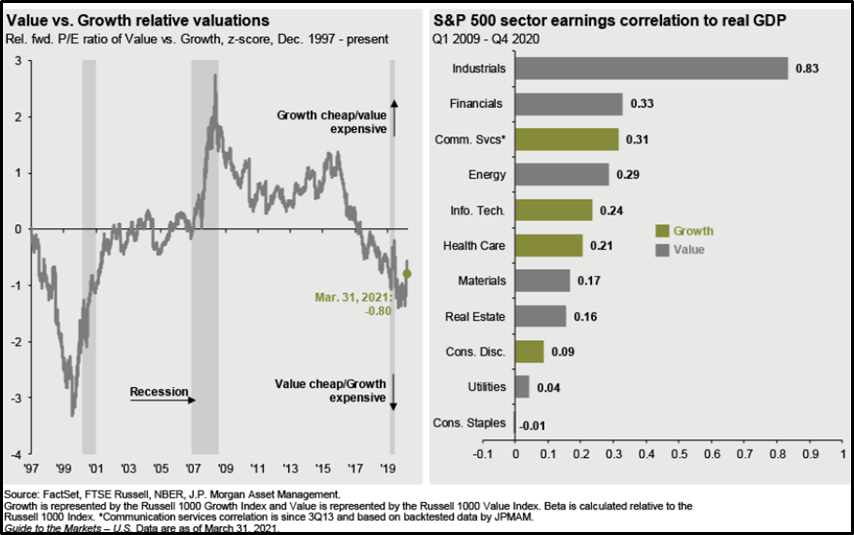

For the second consecutive quarter, mid- and small-cap equities outperformed large cap stocks, and value outperformed growth. The relative strength in small value relative to large growth stocks is particularly noteworthy, with small value advancing 21.4% in the first quarter and large growth falling by 0.4%.

Figure 3. Morningstar Style Box Analysis, 1Q 2021

Notwithstanding the strength of the recent reversal, the longer-term performance gap, current valuations, and the economic backdrop continue to favor the economically sensitive sectors represented in the value category (see Figure 4).

Figure 4. Value versus Growth and Sector Earnings Correlation to Real GDP, 1Q 2021

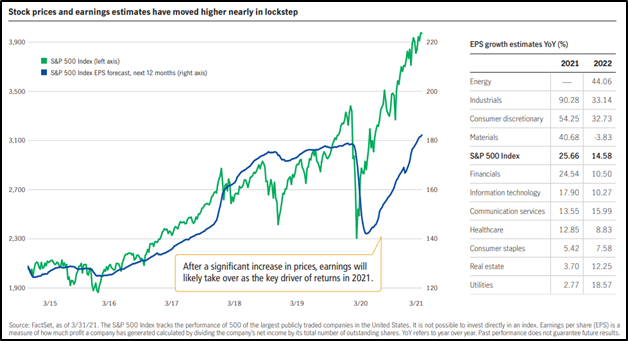

Equity markets are expensive, which is “normal” for this stage of an economic recovery. However, corporate profits are set to recover sharply through year end, continuing the pattern established in early first quarter reporting. Just as we saw estimates chasing reported earnings downward in 2020, we will see the reverse this year. This is particularly true in Energy, Industrials, Consumer Discretionary, and Materials, which took the brunt of the decline during the pandemic.

Figure 5. Stock Prices and EPS Growth Estimates by Sector, 1Q 2021

Non-US stocks underperformed US equities during the first quarter, as US economic activity accelerated more quickly, US interest rates rose, the dollar strengthened, US COVID cases declined, and our vaccination program picked up speed relative to most of the rest of the world.

Bond Market Update

The first-quarter bond sell-off hit Treasuries hardest, followed by safer core and corporate bonds. Only high-yield bonds managed to end the quarter in positive territory. The Fed would like to see inflation average above 2% “for some time” before tightening policy. However, the “bond vigilantes” clearly are speculating that accelerating growth and higher inflation will force the Fed to “take away the punch bowl” sooner than FOMC projections indicate.

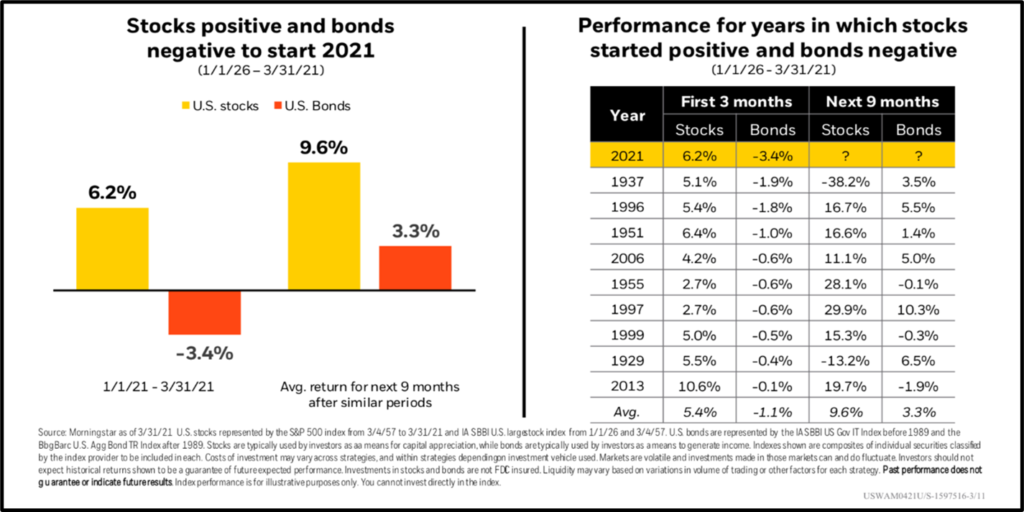

According to BlackRock, a first quarter decoupling in stock and bond prices is unusual. In fact, it has happened only 10 times since 1926, eight of which were followed by nine months of positive stock market returns (see Figure 6). The two periods of equity market declines in the three quarters following a first quarter period of falling bond prices and rising stock prices occurred way back in 1937 and then back in 1929.

Figure 6. US Stock versus US Bond Returns, 1Q 2021

Outlook – Don’t Fight the Fed…or Washington

Interest rates, inflation, and the trajectory of the global economic recovery will determine the fate of the markets for the balance of 2021. Like 2020, investors who stay the course amid market volatility and conflicting prognostications, maintaining well-diversified portfolios geared toward achieving their long-term objectives, will continue to be rewarded.

As expected, the “blue sweep” of the White House and Congress has ushered in greater fiscal stimulus to aid the coronavirus-ravaged economy. This bodes well for equity markets, particularly combined with steady monetary policy and the ongoing roll-out of the COVID-19 vaccine. Nonetheless, we anticipate continued volatility in the coming months – in an upward trend – as the vaccine is rolled-out and new cases ebb and flow simultaneously.

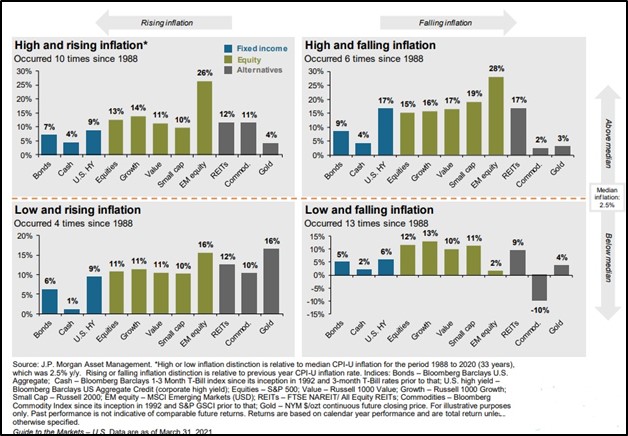

We are likely in the early stages of an inflation “regime change”. As inflation heats up amid unprecedented levels of fiscal and monetary stimulus, we found this chart from JP Morgan Asset Management helpful (see Figure 7). It looks at asset class performance in different inflation environments over the past 33 years and shows that as inflation moves from “low (less than 2.5%) and falling” to “low and rising” – as we are today – developed market equity and bond returns are similar, and emerging markets and real asset returns can be higher.

Figure 7. Fixed Income, Equity, and Alternatives Returns in Different Inflation Environments

Achieving Long-Term Investment and Impact Objectives

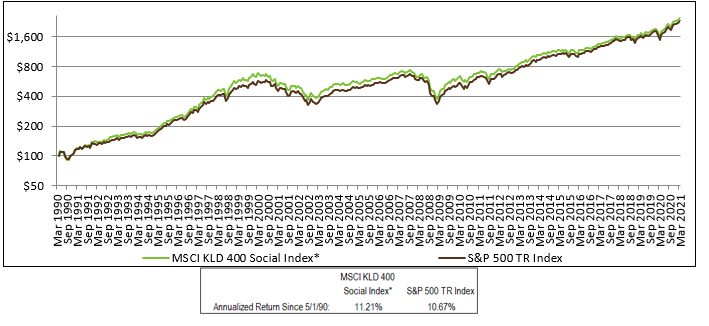

The shift into sustainable, responsible, and impact (SRI) investments remains strong amid the global pandemic – along with rising climate risk awareness, social unrest, and growing recognition that financial and impact objectives can be achieved simultaneously. As shown in Figure 8, the MSCI KLD 400 index outperformed the S&P 500 index in the first quarter. The sustained, consistent performance of this standard SRI/ESG benchmark over time and recent outperformance support our view that strategies incorporating environmental, social and governance (ESG) factors – with an eye toward making the world a better place – and mainstream financial returns are not mutually exclusive.

According to US SIF, “total US-domiciled under management (AUM) using environmental, social, and governance (ESG) strategies grew from $12.0 trillion at the start of 2018 to $17.1 trillion at the start of 2020, a 42% increase. This represents 33% of the total US assets under professional management”. We anticipate continued growth going forward, with a shift toward increased scrutiny of ESG funds by investors, and a focus on impact performance measurement by asset managers.

As always, everything we do at First Affirmative is driven by our dedication to enabling advisors to deliver financial results to clients and belief in the power of capital to bring about lasting environmental and social change. Our three Sustainable Investment Solutions – Custom, Multi-Manager, and Managed Mutual Fund – are built to enable clients to achieve their financial goals over the long term, along with their individual environmental, social, governance, ethical, and values-based objectives. Each portfolio is carefully constructed to be well diversified across assets, sectors, geographies, securities, and management styles –– and designed to weather periods of uncertainty and volatility.

Figure 8. MSCI KLD 400 vs S&P 500 Indices, 3/31/2021

Source: Morningstar. *Data prior to 9/1/2010 is that of the MSCI KLD 400 Social Index GR, while data since 9/1/2010 is that of the MSCI KLD 400 Social Index NR. Indexes are unmanaged groups of securities. Index performance does not include the impact of cash, fees, or transaction costs. Investors cannot invest directly in indexes but may purchase mutual funds or other investment products designed to track the performance of various indices.