Grow your Business today with VADIS

For the Second Year in a Row…

VADIS receives top ratings in multiple categories in the 2025 T3/Inside Information survey.

We Stand Out!

Do you want to grow your business? We can help.

In a collaborative effort, First Affirmative and YourStake have developed our Values-Aligned Direct Index Solution. This cutting-edge portfolio management solution empowers RIAs to deliver low-cost, fully customized, tax efficient investment strategies to their clients.

In Latin, “vadis” means, “where are you going?” With VADIS, you and your clients are moving toward a future where their investments reflect the impact they want to see in the world, with transparency and customization. Help your clients achieve their financial and impact objectives on our multi-custodial platform with as little as $25,000 to invest.

Explore more VADIS insights and other Industry News:

VADIS Overview– Unlock value for every client’s values

New to Shareholder Advocacy – Showcasing the power of active ownership

We Stand Out! – VADIS receives top ratings in the 2025 T3/Inside Information Survey

Recent Market Commentary – The future is not what it used to be. – Q1 2025 Market Commentary

First Affirmative News – Empowering Generational Wealth Transfer Through Values-Driven Investment Strategies

Three Ways to Implement VADIS

Grow your Business with Values-Aligned Direct Indexing

Portfolio Optimization: First Affirmative utilizes trading and rebalancing tools powered by Orion, along with client’s customized screens to create tax-managed SMA portfolios, customized down to the individual company equities to include or exclude.

Personalized Client Values Alignment: Client onboarding tools are designed to identify a client’s “Behavioral Values” via a Myers-Briggs style behavioral questionnaire for impact investing.

Add tax alpha to client portfolios: Clients can capitalize on tax loss harvesting opportunities and defer capital gains.

Dynamic, Real-World Reporting: Impact Performance reports compare a VADIS portfolio incorporating your clients’ personal values to the benchmark and/or an existing portfolio, demonstrating the efficacy of our values alignment capabilities. Advisors and their clients may access an individualized YourStake impact performance report using their Orion portal, in addition to a traditional performance report.

Evidence-driven NoScore data Screens: Dynamic, personalization “NoScore data” screens for funds and individual stocks leverage transparent data from more than 100 independent sources that meet global regulatory standards.

Benchmark flexibility: Advisors can work with their clients to determine an appropriate and customized benchmark or risk profile for their portfolio.

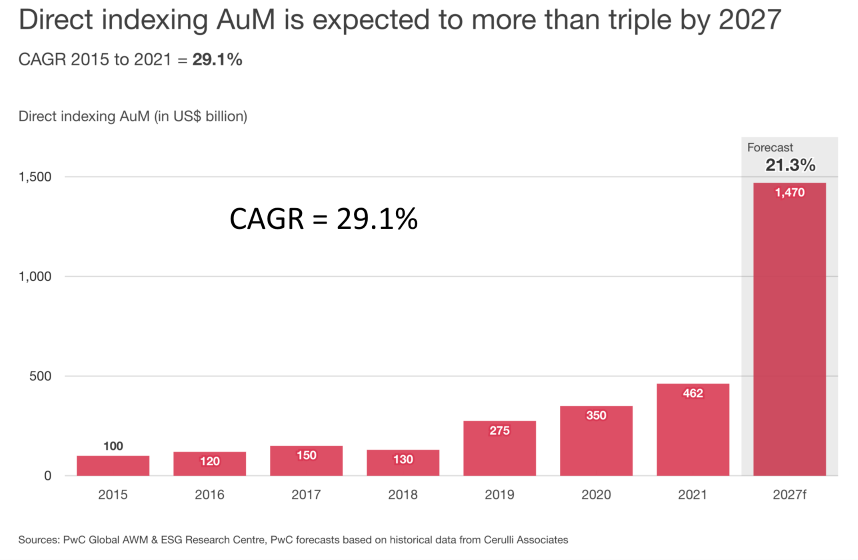

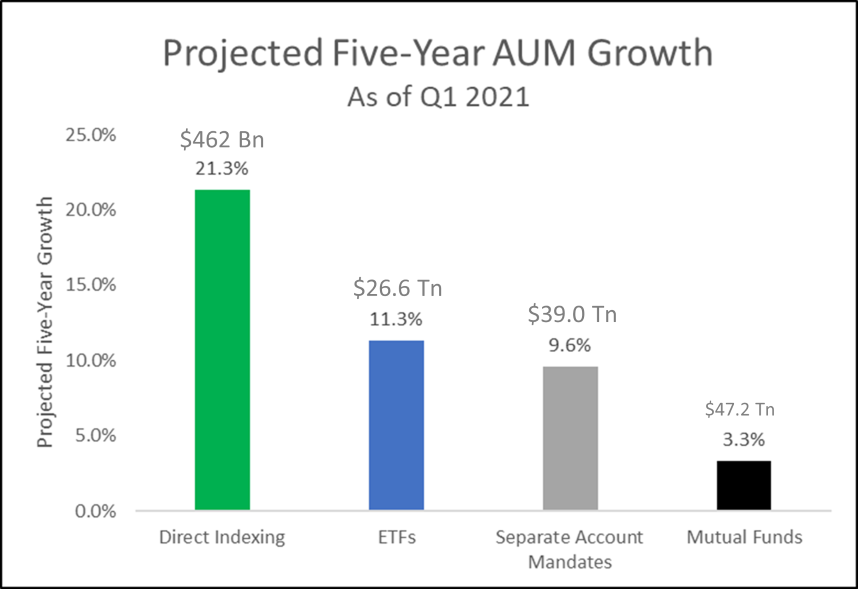

Direct Indexing Growth and FAQs

Let’s grow your investments together.

Join others that have become a part of this movement.

Advisors: Get the ins and outs about First Affirmative’s Values-Aligned Direct Index Solution (VADIS). Learn how you can customize client portfolios, distinguish values-based Investments and align strategy with financial goals. Click here to learn more.

The Business Development Team, is ready to talk with you about VADIS and exactly how it will help you direct your clients’ wealth to the impact areas that matter most.

You can connect with us directly by clicking the Schedule Demo button on this page.