The Stars Align for a Blockbuster Proxy Season

We are delighted to report that concerns that a new SEC rule designed to restrict shareholder proposals on ESG issues have been overshadowed by overwhelming evidence that efforts to restrict the shareholder voice have backfired. A changed landscape at the Securities and Exchange Commission (SEC) that increasingly supports investors, coupled with enhanced investor awareness that the issues raised by shareholder proposals warrant action, are setting up a proxy voting season for the record books.

_______________

SEC Action: Amended SEC policy when considering “no action requests” from companies that, if approved, allow them to omit a shareholder proposal from the ballot. The amended policy allows the SEC staff to consider broader social policy considerations when evaluating requests from companies. The result is that fewer companies are being granted these requests, and proposals addressing key concerns that have been omitted in prior years are now going to be on the ballot.

Impact: Sustainable Investments Institute reports that the SEC has rejected 30% of corporate no action requests as of 3/31, compared to last year’s rejection rate of 49%. Shareholder proposals asking for climate action (not just disclosure) and for disclosure on paid sick leave policies that were omitted from company ballots last year will go to a vote this year.

_______________

SEC Action: Investors welcomed the late March announcement of proposed rules designed to standardize climate related disclosures for investors. The proposed rule includes mandatory reporting that aligns with existing voluntary reporting frameworks. The rule covers greenhouse gas emissions, physical and transition risk, financial impacts of severe weather events and other natural conditions (with specific line items in the audited financial statements), and progress on targets and goals.

Impact: There is likely to be significant pushback from specific industries, such as fossil fuels, but assuming the proposed rule remains relatively intact following a 60-day comment period, investors will finally have standardized, comparable information from companies that is crucial to making sound investment decisions. It is also likely to reduce the need for filing shareholder proposals company by company to demand this information and enhance engagement activities with our portfolio companies.

_______________

Investor Action: Despite the new rules designed to curtail the number of shareholder proposals filed at companies, investors collectively found a way to make this a record-setting year anyway. There are more first-time filers, and investors like First Affirmative found ways to adapt to the rules without compromising their engagement programs. Many investment management firms are also updating their proxy voting guidelines to reflect their increasing need for enhanced disclosures.

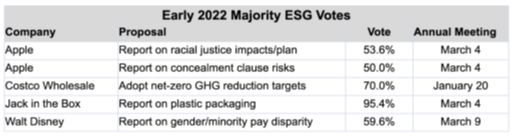

Impact: Proxy Preview 2022 indicates that as of mid-March,529 shareholder proposals have been filed on ESG issues for the 2022 proxy season. This is an increase of more than 20% from last year. 106 proposals had already been withdrawn after dialogue. Five majority votes (see table below) on a broad array of issues have already been recorded, an indication that last year’s record-breaking 39 majority votes will be surpassed.

Source: Sustainable Investments Institute

_______________

Investor Action: Many investors, including First Affirmative, have amended proxy voting guidelines to increasingly hold board members responsible for oversight of ESG issues, particularly of climate and diversity oversight, to account by voting against them.

Impact: Stay tuned! We expect support for board members responsible for climate oversight at lagging companies to decrease over time, but how major institutional managers implement their policies on a company-by-company basis will determine how broad-based this trend becomes. Support for board members has consistently been very high, averaging well over 90%. Eroding investor support for board members coupled with increasing investor support for shareholder proposals may move reluctant companies to action.

___________

First Affirmative Engagement Highlights

First Affirmative has filed nine shareholder proposals to date, three of which have already been withdrawn after successful dialogue at Tractor Supply, Citi, and Kroger. Although the new SEC rules did make it more time-consuming to file proposals and prevented some of our clients from being able to participate in the process, other clients with qualifying shares allowing us to file on their behalf meant that we could continue our work with minimal disruption.

In Depth: Climate Action at Tractor Supply

We first contacted Tractor Supply in November 2020 to express our concern that the company had yet to adopt renewable energy, which at that point was less than 5% of their energy use. We subsequently had productive conversations with regard to renewable energy as well as the Company’s broader climate action plan. We were pleased that the company subsequently joined the Renewable Energy Buyers Alliance, established significant renewable energy goals, and have since increased the renewable energy portfolio to 18% since our initial conversation. However, we decided to file a shareholder proposal asking the company to address our concerns with regard to measuring and reducing its total contribution to climate change, including emissions from its supply chains, to align its operations with the Paris agreement’s goal of maintaining global temperatures increases well below 2°.

Further discussions yielded a withdrawal agreement as the company has made significant progress on both disclosure and goal setting.

Tractor Supply:

- expanded its reporting significantly in alignment with our expectations for comprehensive disclosure in accordance with Task Force for Climate Related Disclosure (TCFD) recommendations

- hired a Director of Sustainability responsible for policy implementation

- set aggressive goals for Reducing Scope 1 and 2 emissions

- Will continue our engagement during the process to update us on their progress on establishing policies and procedures to properly measure, manage, and reduce Scope 3 emissions (those primarily generated by their extensive supply chain)

Mention of specific securities is not an offer to buy or sell that security. For information about the suitability of an investment for your portfolio please contact your advisor.