2021 Annual Engagement Review

Engagement Overview

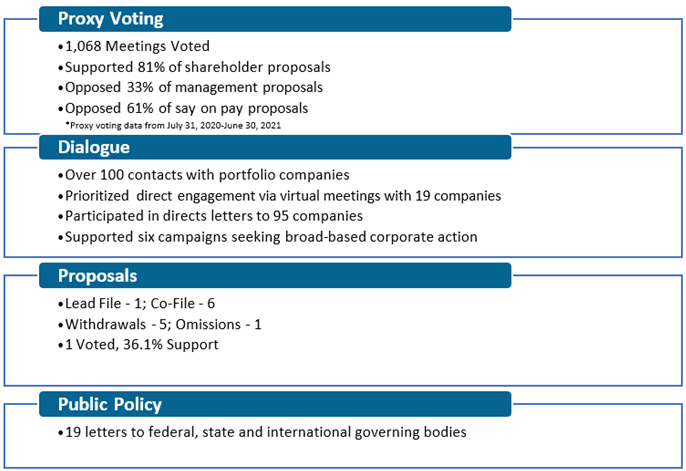

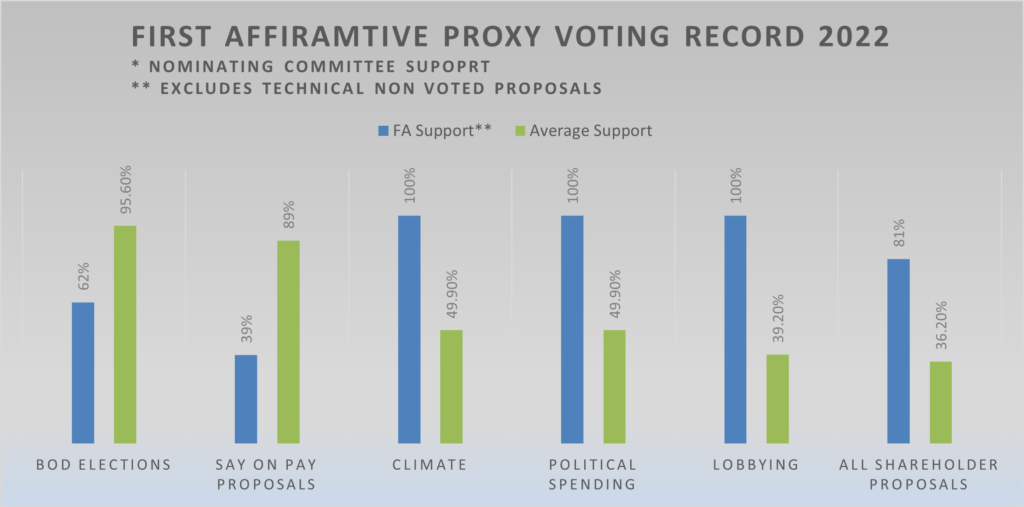

First Affirmative’s proxy voting record continues to reflect our steadfast support for a just, sustainable economy, but the big news in proxy voting for 2021 is what other investors are doing! Investor support for key environmental, social, and governance (ESG) proposals has been slowly building over the last few years, but 2021 was stellar, with record-setting increases in support across the board. As of June 30th, which is considered the end of the annual shareholder meeting season, an all-time high of 34 environmental and social proposals received majority support from shareholders, with climate, racial equity, and political spending all in the spotlight.

This chart showing the stats of climate proposal outcomes illustrates the remarkable difference a year can make. Major institutional investors continue to strengthen their proxy voting policies as the financial risks of climate change become increasingly apparent with each passing “unprecedented” firestorm, drought, hurricane, and tornado.

| Climate Proposals: | 2021 | 2020 | Change |

| Submitted | 83 | 54 | ↑56% |

| Voted On | 23 | 16 | ↑44% |

| Average Support | 49.9% | 32.1% | ↑18% |

| Majority Support | 11 | 4 | ↑175% |

| % Withdrawn | 61% | 43% | ↑18% |

First Affirmative continues to engage with our institutional money managers on this issue and will be engaging in dialogue with our proxy voting firm, Institutional Shareholder Services, to encourage enhancement of research and benchmarking policies that many investors rely on to shape their own proxy voting policies. We have also joined investor campaigns to advocate for voting against directors who fail to properly oversee and address ESG risks.

The Next Frontier: Climate Accountability in the Board Room

Voting against a board member is still a rare occurrence amongst mainstream investors, with average support over 95%, but we believe that holding board members accountable for their Company’s performance on key issues like diversity, executive compensation, and climate is the most important signal an investor can send to facilitate change at the top. Our proxy voting guidelines already lead us to vote against directors responsible for oversight of diversity and compensation at lagging companies, and in 2021 we strengthened our guidelines for climate oversight.

From our 2022 guidelines:

The physical and financial risks posed by climate change are systemic, portfolio-wide, and undiversifiable. Company action, or failure to act, that directly or indirectly impact climate outcomes pose risks to the financial system as a whole, and to our entire portfolio. We may oppose the election of directors responsible for the oversight of climate risk.

Our evaluation will prioritize portfolio companies in sectors with the most significant impact, to include fossil fuel producers, heavy emitting industries, and banking institutions most responsible for financing these sectors.

Our criteria will strengthen and expand to other sectors over time. Directors responsible for climate oversight that do not rapidly adopt and, more importantly, implement a transition plan to aligning corporate targets with limiting warming to 1.5 degrees C will be held accountable.

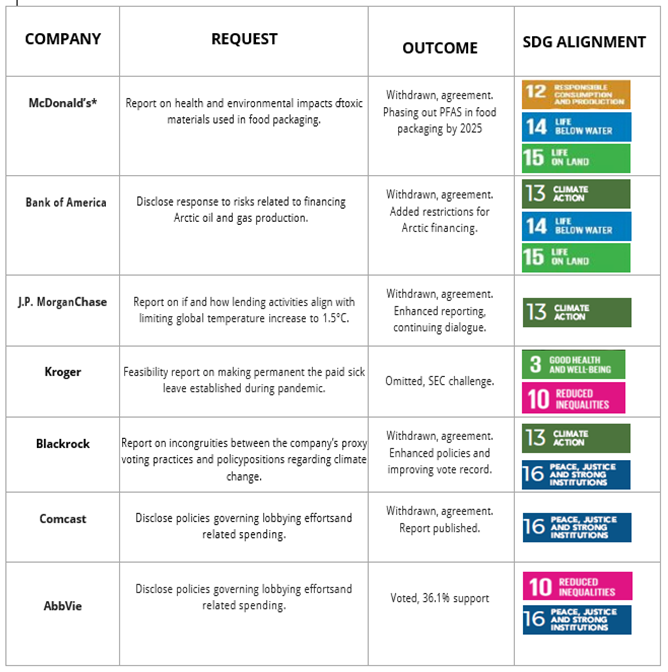

2021 Shareholder Resolutions

Filed or Co-Filed by First Affirmative Financial Network for Annual Meetings held in 2021

Engagement Highlights

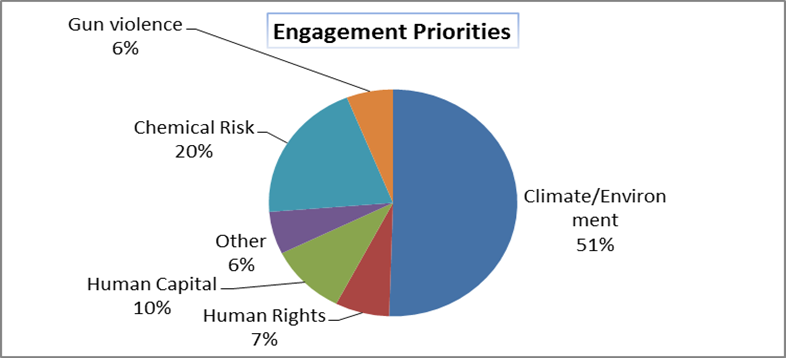

Climate and Environment

- In a first for us, we hosted a dialogue between two of our portfolio companies. Industry peers ADP and Iron Mountain both have heavy data center exposure, but ADP has yet to adopt renewable energy while Iron Mountain’s data centers have been powered by renewable energy since 2017. ADP has since committed to establishing science-based targets, and they will be providing details in an upcoming dialogue.

- As a signatory to the CDP, a global platform for climate, water, and deforestation data disclosure, we participated in a campaign urging 19 of our portfolio companies to disclose greenhouse gas emissions annually including taking the lead in contacting Caterpillar on behalf of 44 global investors. Five of these companies submitted climate surveys to the CDP for the first time. We have participated in this campaign for over five years because companies engaged in the campaign were 2.3 times more likely to disclose if investors directly request them to do so.

- We joined an investor coalition in petitioning Congress and the EPA to provide permanent protection for pristine Bristol Bay and permanently stop the proposed Pebble Mine.

- We joined Share Action’s campaign at seven companies to electrify auto fleets at companies with significant exposure.

- We joined an investor coalition urging Institutional Shareholder Services to strengthen their climate research and benchmark climate proxy voting policies to better align with investor expectations. We also commented on their proposed benchmark policies for 2022.

- We signed an investor statement asking companies to withdraw from the American Legislative Exchange Council (ALEC). ALEC has helped to craft and endorse model legislation to block climate action, the most recent being to prevent mandatory disclosure in accordance with the Task Force on Climate Related Disclosure (TFCD) guidelines.

- We continue our decade-long engagement regarding climate with Fifth Third Bank. The bank made significant progress in the last year by establishing financed emissions as a priority. They have significantly enhanced their disclosures and joined Partnership for Carbon Accounting Financials (PCAF) and CERES to support their work to reduce financed emissions.

- We weighed in on several state and federal policy issues, including support for renewing the federal renewable energy tax credit and repealing recent EPA decision with regard to methane emissions — both succeeded. We commented on the Colorado draft transportation plan, which also succeeded, as well as supported the Colorado energy benchmarking program that has now passed committee.

- We commented to the SEC to support mandatory ESG reporting.

- George Gay, our CEO, wrote an op-ed discussing the need for strong climate policy action.

Chemical Risk

- The high shareholder support for our chemical risk management proposal at TJX last year has led to an ongoing dialogue with the company in conjunction with NGO partner Clean Production Action, resulting in significant commitments and improved outcomes. Our leadership on chemical risk engagement was recognized as we were invited to author the introduction and speak at the launch of the fifth annual Chemical Footprint Project, a survey assessing corporate chemical risk management policies and progress.

- We signed the Chemical Disclosure Principles investor statement, a document that outlines our expectations of companies that will serve as a baseline for discussions with regard to chemical risk going forward.

- As part of our work with Investors Environmental Health Network, we signed a letter asking for disclosure on pesticide policies at 12 consumer facing companies. These letters enabled productive dialogues with Costco, Johnson & Johnson, and Hasbro. Expect some shareholder proposals in 2022 at companies where insufficient progress has been made.

Human Capital

- We partnered with Corporate Knights in a campaign to engage 14 companies that performed poorly or did not respond to Corporate Knight’s first annual paid sick leave report, which assessed the adequacy of permanent corporate paid sick leave policies. Three productive dialogues and four written responses to date have broadened our knowledge and will help guide further engagement. We have recently joined another investment campaign that will expand our engagement on this issue. It is clear that progress on paid leave, particularly for lower paid part-time workers, will require significant public policy action. We joined over 100 other investors asking Congress to pass a federal family and sick leave policy.

- We signed a letter to Tesla asking for an end to forced arbitration, a practice that can obscure serious workplace issues and contribute to a hostile work environment by avoiding systemic change in an organization.

- We supported a minimum wage plus tips campaign that would support a living wage for key service workers.

- We signed an investment statement targeted at Russell 1000 companies demanding information on workplace equity policies, programs, and outcomes.

- We sent a comment to the SEC in support of mandatory EEO disclosure for public companies.

Human Rights

- We signed a letter sponsored by Adasina that asked banks and investors to refrain from buying bonds to support a for-profit prison in Alabama. This campaign significantly contributed to the deal subsequently failing due to lack of demand.

- We joined an investor statement sent to the 106 companies that scored zero on the latest Corporate Human Rights Benchmark Report, which assesses corporate performance on a set of human rights indicators as established by the UN Guiding Principles on Business and Human Rights.

- We once again supported the Accord on Fire and Building Safety and Bangladesh that was founded after 2012 fire that killed 117 people. It has been renewed.

Gun Violence

- We continued our work on gun violence by joining an investor coalition to send letters to MasterCard and Visa regarding their facilitation of the purchase of “ghost guns”, which consist of easy to assemble parts purchased readily online, creating guns that are increasingly used in violent crime. We have co- filed a shareholder proposal with MasterCard for 2022 on this issue. We also contacted Federal Express and UPS to discuss shipping of these items.

Shareholder Rights

- We committed $500 to support an ongoing lawsuit attempting to repeal SEC rules that makes it more difficult to file shareholders and prevents key ESG issues from being presented for a shareholder vote. This lawsuit continues, and in the meantime proposals for 2022 annual meetings will be filed in accordance with these more restrictive guidelines.

- Although the more restrictive guidelines have made it more difficult to file proposals in some cases, we are pleased that the SEC has become far more supportive to investor concerns. As a member of the Shareholder Rights Group, we supported a letter and dialogue with the SEC that contributed significantly to the issuance of a new SEC bulletin. This bulletin enables shareholders to make specific ESG requests in their proposals with less risk of companies succeeding in their petitions to the SEC to block them from the ballot. For example, the bulletin restored the ability of shareholders to file proposals asking a company to set greenhouse gas reduction targets aligned with global goals.

Activist Managers Engagement Highlights

First Affirmative utilizes numerous management firms that also actively engage with their portfolio companies. Here are just a few engagement highlights

Submitted testimony to the University of Michigan Board of Regents in February regarding the social and financial imperatives to implement a fossil fuel and other harmful activity divestment policy. The University committed to becoming “net zero” across their endowment by 2050. They partnered with Investor Advocates for Social Justice file a proposal asking for an evaluation of misalignment between its lobbying activities and company values. Zevin met with Vanguard and State Street, two of Microsoft’s largest shareholders, to make the case for this proposal. Shareholder support of 38% was a very strong showing for a proposal of this type.

Trillium’s extensive engagement on diversity and racial justice paid off with two record-setting proxy votes — 91% support at First Solar on board diversity and 94% support at Paycom on executive team diversity. Trillium also pioneered a new shareholder proposal focused on racial justice audits, and their first vote achieved 37% support, paving the way for similar proposals at key companies in 2022. Trillium’s advocacy team includes extensive legal expertise as well. The firm joined a Supreme Court amicus brief with companies such as Levi Strauss, PayPal, and Ben and Jerry’s in support of the Voting Rights Act (VRA). At the federal level, they met members of Congress to discuss the environmental justice and the infrastructure bill.

Boston Common asked several US portfolio holdings to stop political donations to representatives who opposed the election results and to consider closing their corporate Political Action Committees (PACs). UPS stopped all PAC contributions and Microsoft suspended its PAC contributions to these individuals for the 2022 election cycle. They also continue to conduct extensive research on and lead engagement with banks regarding financing the fossil fuel industry, including securing a recent commitment from Citigroup to reach net zero by 2050.

Impax has extensively researched and launched an initiative to address the social and financial impacts of artificial intelligence and algorithms that have proven to generate racial and gender biased outcomes. They are asking companies that produce biometrics or algorithms to disclose racially biased outcomes from use of their systems, and ask them to regular audits to check for bias. Impax also produced a short but powerful video discussing climate impacts with a focus on physical risk, providing insight into their advocacy priorities in this area.

Calvert engaged with 37 companies that lacked diversity in board and executive leadership. Of these, they filed resolutions with six companies that did not respond. All were withdrawn following dialogue with significant corporate commitments. Calvert also stepped up efforts to address climate change, emphasizing the utilities and banking sectors. Following engagement with one electric utility, the company added board members and linked executive compensation to the achievement of renewable energy investment objectives.

Azzad continues to focus on human rights issues, engaging with Chevron regarding payments to the military junta in Myanmar, Alphabet regarding their acquiescence to suppressing or censoring information at government request in some countries, and at Expedia regarding listing properties for rent in conflict zones.

As a leader in a decades long campaign for public disclosure of EEO data that would give investors essential data on workforce diversity and composition, Boston trust Walden has engaged hundreds of companies and filing numerous resolutions seeking EEO-1 disclosure dating back to 1993. First Affirmative joined this effort recently in an investor letter to the SEC supporting mandatory EEO disclosure by public companies.

Continued their in-depth work on Forests & Finance, holding calls with over a dozen companies to identify best practices and industry leaders while also identifying criteria for which companies need to improve practices.

Everence’s human rights focus was evident in shareholder proposal filings on racial justice, paid sick leave, and engagement on raising the minimum wage and human trafficking.

Earned the highest support (98%) ever recorded on a deforestation proposal at Bunge, one of the four largest global agricultural commodity traders. Green Century garnered rare support from the Board of Directors for their request to strengthen deforestation policies. Green Century also announced significant commitments from the Archer-Daniels-Midland Company and JPMorgan Chase on deforestation.