Overview:

The past few years have tested the resilience of humanity. This test does not appear to be over, as evidenced by global GDP growth, which has yet to return to pre-pandemic levels.

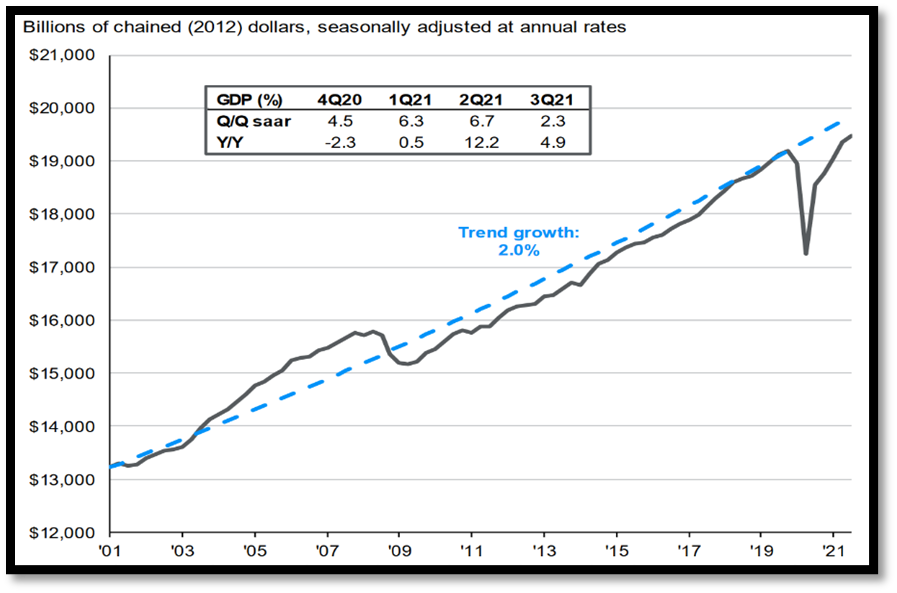

Figure 1. Real US GDP

While normalcy has yet to return to most countries globally, it appears to be returning to United States’ GDP, as seen above in Figure 1. This figure shows that the United States’ GDP is on track for return to its average pre-covid trend and should return this trend over the next year. There are, however, obstacles to this goal of economic regularity. These obstacles include the litany of issues that revolve around COVID-19, lack of consumption, worker scarcity despite wage growth, a rising consumer price index, and high inflation. These topics will be delved into in this economic overview, along with a glance at how global clean energy initiatives are faring.

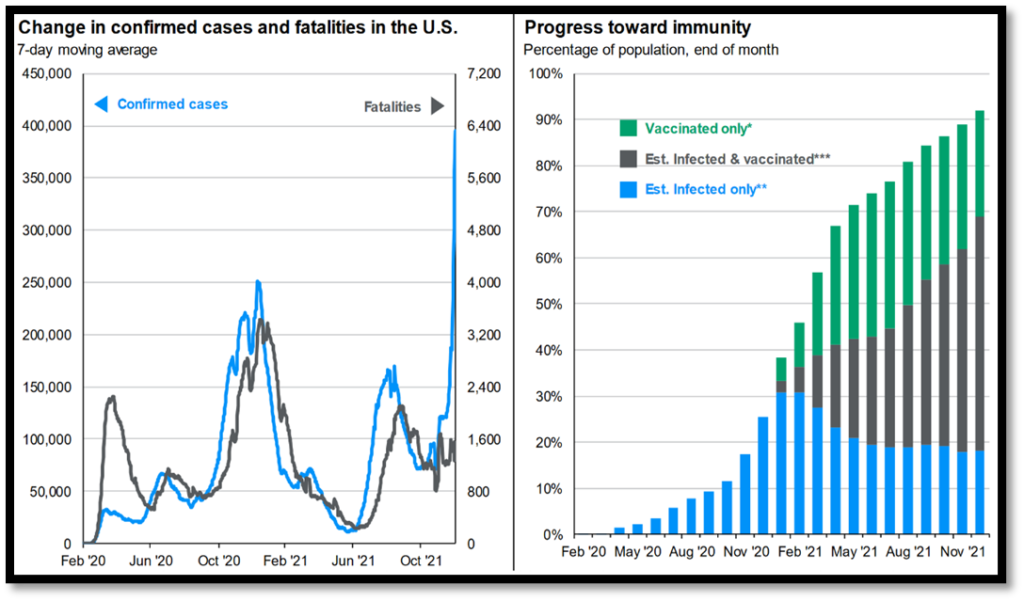

Figure 2. Change in Confirmed Covid-19 Cases in the US and Progress Toward Immunity

As shown in Figure 2 above, confirmed COVID cases have seen a massive rise with the onslaught of delta and omicron, while fatality rates have fallen. The rise in cases has been keeping people in fear, but the lack of fatalities in this recent massive wave of sickness is a good sign and worthy of note; while a lot of people may be infected, we are learning how to prevent their deaths and are dealing with the virus better as a society. As we see vaccination rates rise, also shown in Figure 2, we have continued to see rises in infection rates, but see far fewer deaths from the disease. Based on this, it is possible that the vaccination is helping keep the virus from being fatal, possibly allowing a new normal to be created with COVID being treated as any other seasonal infectious disease, like the flu.

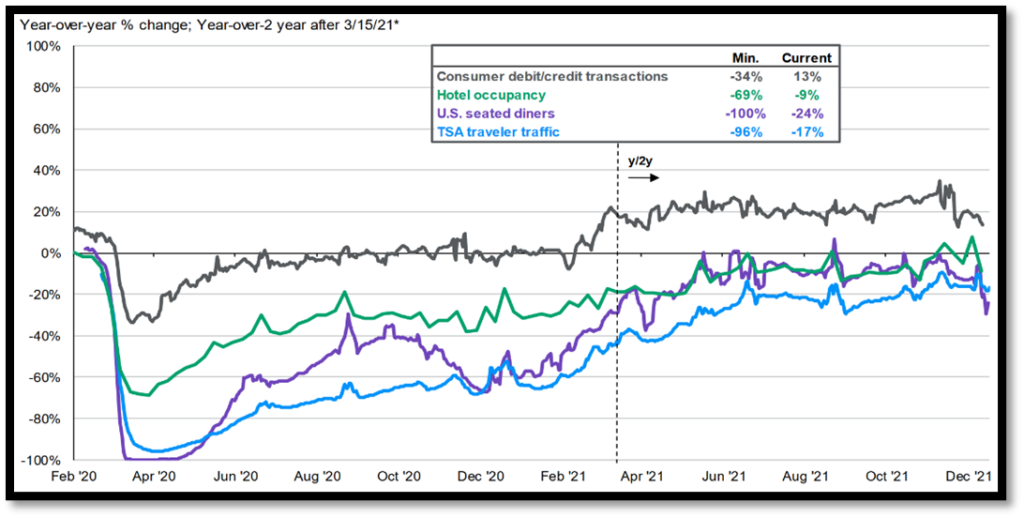

Figure 3. High-Frequency Data for US Consumers

As shown above in Figure 3, consumer spending dipped during the holiday season, when it normally spikes. The trends for the year seem to be rising, but with new strains of covid, people seem to be becoming more guarded with their money. Based on this chart, people are also still afraid to travel, even for the holidays, as this chart shows travel-related expenditures at lower levels than consumer price transactions, the average of consumer expenditure across many categories.

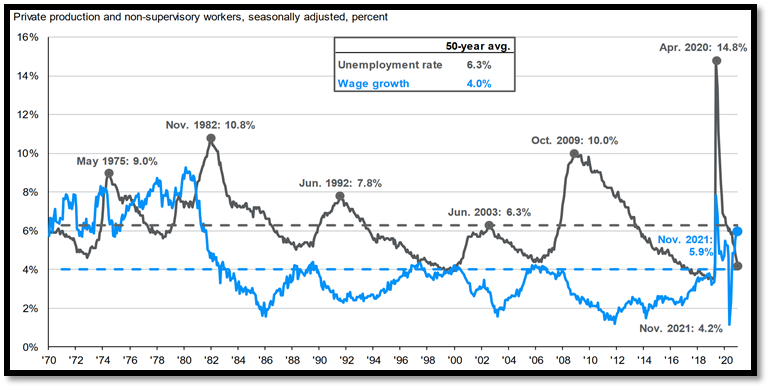

Figure 4. Civilian Unemployment Rate and Year-Over-Year Wage Growth

As seen above in Figure 4, the unemployment rate has returned to more normal levels as pandemic-related unemployment benefits were curtailed and wages increased to reflect inflation and worker shortages. This is great news considering that unemployment was recently at an unprecedented level of 14.8% due to the pandemic. While other countries are still struggling with the pandemic and their workforce, the US is entering new normalcy at a faster rate and people are starting to go to work now that wages are rising.

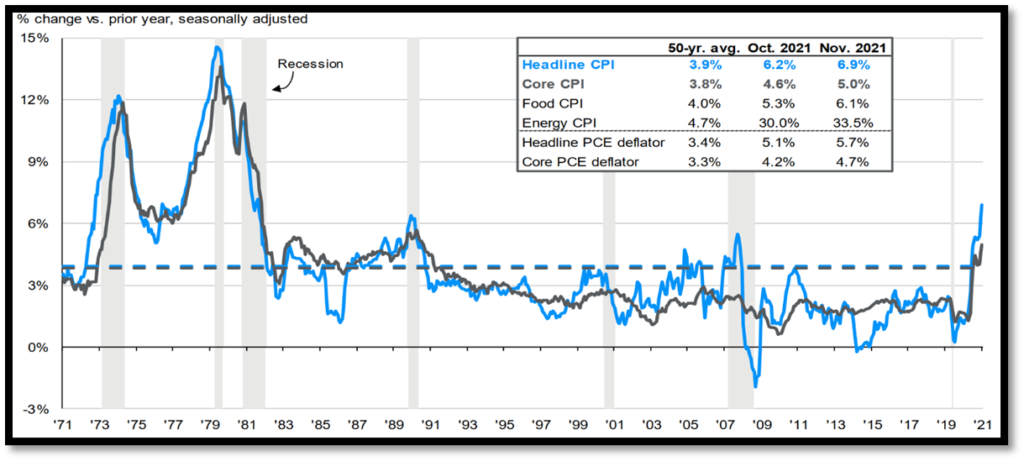

One issue with rising wages is that they may not rise enough to satisfy the workforce. This can be seen in the US consumer price index (CPI) rising, which would show the average prices of goods for consumers across headline, core, food, and energy metrics. All of these categories rose greatly in the past few months. Figure 5 below, shows exactly this; the CPI for the US consumer has risen to above average levels and is currently at higher levels than the CPI was at during the recession of 2007. All goods, including food and especially energy, are more expensive, meaning the wage increases for workers may not be large enough to be able to live comfortably.

Figure 5. CPI and Core CPI

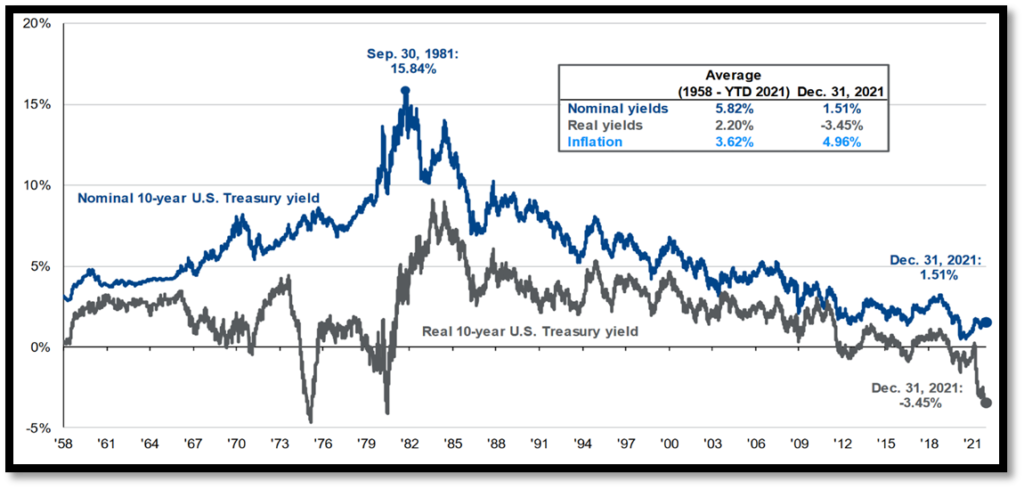

As shown in Figure 6 below, nominal yields are at a low currently not seen since 1982; real yields are staggeringly negative compared to the average trend from 1958-2021; inflation is at 4.96%, which is higher than the 1958-2021 average by 1.34%, suggesting interest rates must rise, inflation must fall, or we will see some combination of the two.

Figure 6. Nominal and Real U.S. Treasury Yields

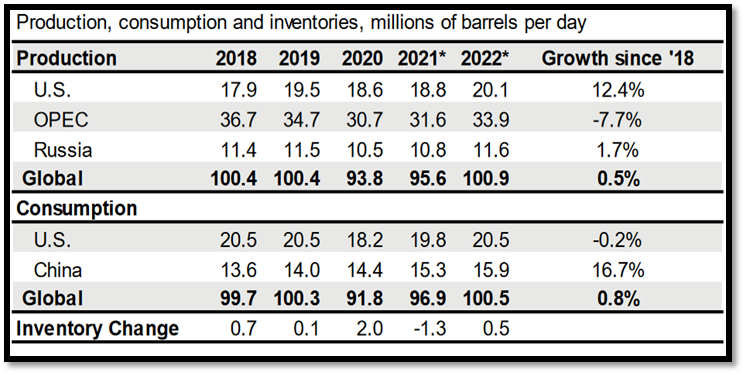

There also are many environmental issues facing the world today. Many countries have taken a stance to attempt to combat these issues through environmental policies and corporate regulations. As shown in Figure 7 below, the United States has done the opposite, showing 12.4% growth in oil production since 2018. This is significant compared with OPEC’s decreased production and Russia’s 1.2% increase. This is in contrast to the United States’ climate initiative to be using 100% pollution-free electricity by 2035, as promised by the Biden Administration. Please note that 2021 and 2022 are forecasted by the December 2021 EIE Short-Term Energy Outlook and starts in 2021.

Figure 7. Change in Production and Consumption of Liquid Fuels

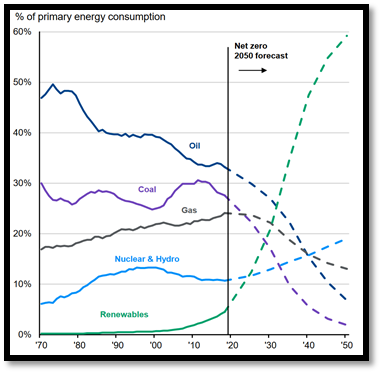

Globally, we may not be on track to be net zero emissions by 2035 as laid out in the United States’ plan, but by 2050 there is a plan in place to reach net zero, as shown in Figure 8 below. Many countries are currently, and have been, cutting down on their usage of non-renewable energy such as oil, coal, and gas. At the same time, they are raising their usage of renewable energy sources, hydroelectric power, and nuclear power to foster a cleaner environment with less human impact. This is all being done with the hope of combating climate change, a major force in the economy and in human survival as a race.

Figure 8. Global Energy Mix

Main Risks:

- Increase in US oil production combating its, and the world’s, clean energy initiatives.

- Prices of all goods continuing to rise while demand on goods remain the same, creating discourse in society.

- Unemployment rates fall further – as a result of departures from the work force, exacerbating wage increases.

- Inflation rates continue to rise globally.

- People are becoming afraid of COVID again and economic activity is down.

Looking Ahead:

- GDP recovering to normal levels.

- Rise in wages attempting to combat high unemployment.

- Renewable energy initiatives continuing to be adhered to at the global level.

- Prices will continue to rise across the board.

- COVID will continue disrupting supply chains alongside worker scarcity.

- Countries devoted to reversing the effects of climate change continue to push towards net zero emissions.