COVID Uncertainty and Accelerating Inflation Increase Market Volatility

By Theresa Gusman July 21, 2021

Overview

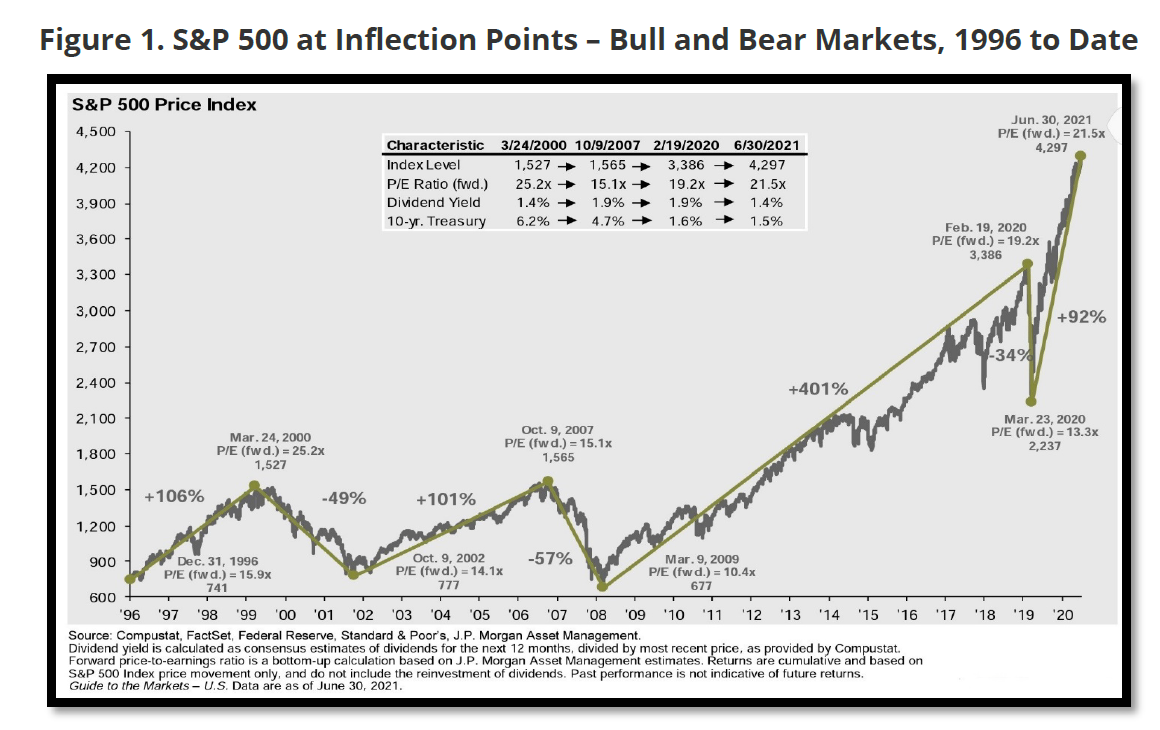

At second quarter end, the S&P 500 was 92% above its March 23, 2020, pandemic low and 27% above its pre-pandemic high (see Figure 1). With vaccination rates rising and economic activity accelerating, we entered the summer with the sense of optimism we had lost over a year of quarantine, shutdowns, face masks, and financial, societal, and personal upheaval. Unfortunately, it appears this optimism could be tempered: Vaccination rates have leveled off, the number of COVID cases – particularly instances of the highly contagious Delta variant – are rising, mask requirements are resurfacing, mandatory inoculation is under discussion, inflation is dominating the economic headlines, and gridlock has returned to Washington.

Against this backdrop, volatility has returned to global markets and will continue as new COVID-related and economic data are digested.

Figure 1. S&P 500 at Inflection Points – Bull and Bear Markets, 1996 to Date

Second Quarter Market Review

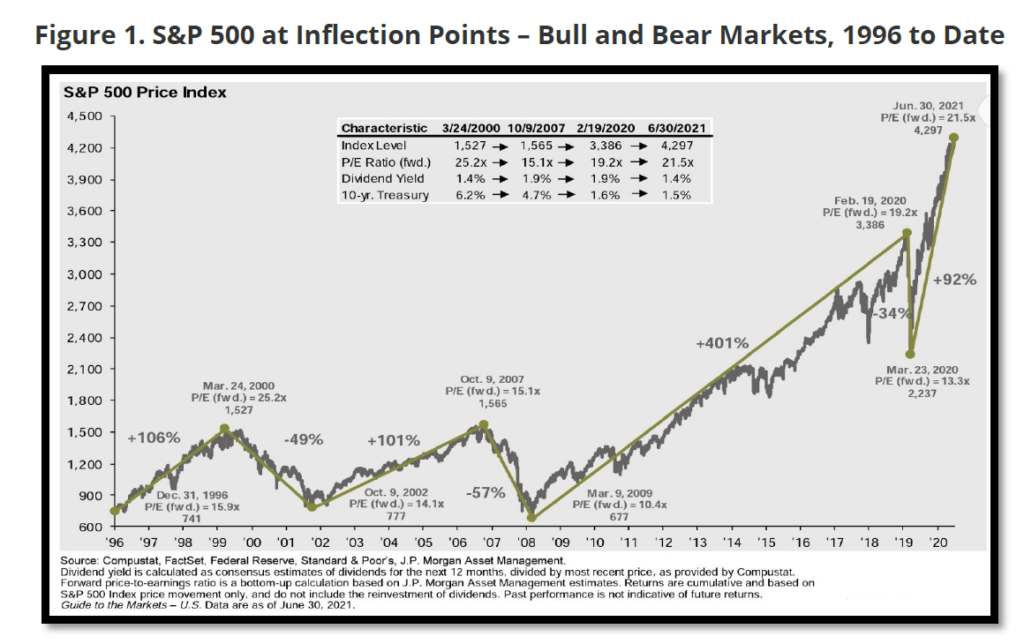

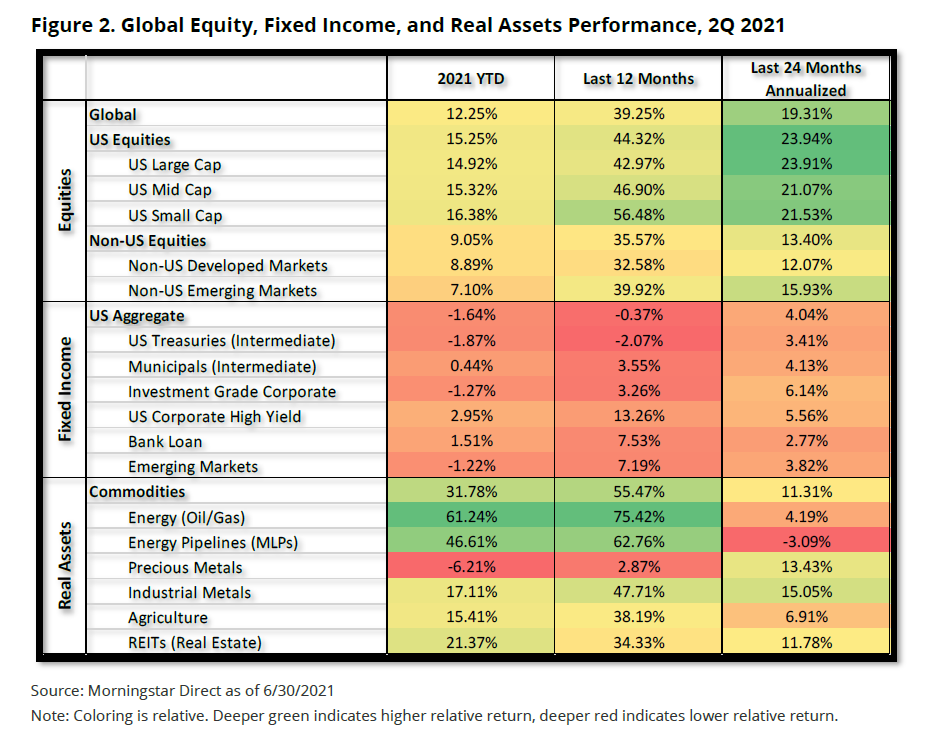

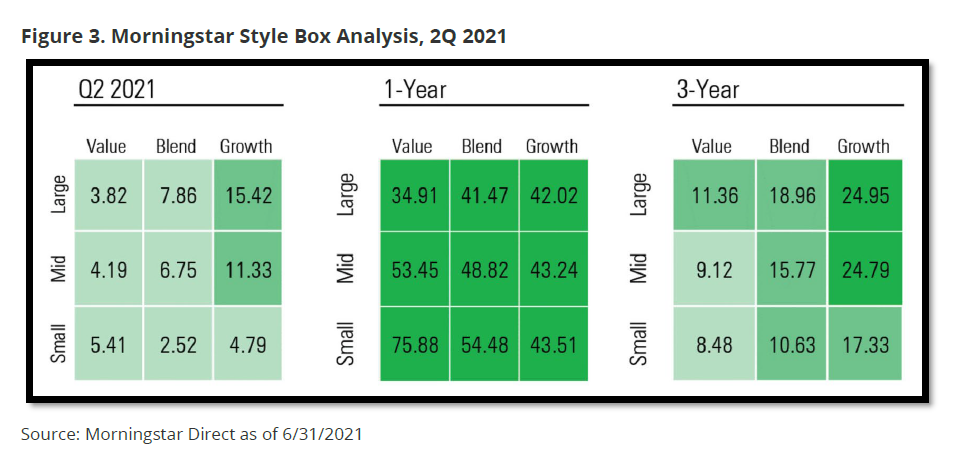

Global equity markets continued to move higher in the second quarter (+7.4%), boosting the return for the year-to-date to 12.3% (see Figure 2). US stocks (S&P 500 +8.6%) continued to outperform non-US (+5.2%), with developed and emerging markets moving in lockstep in the second quarter. For the first time in three quarters, large cap stocks outperformed small, and growth stocks outperformed value (see Figure 3). Also, whereas bond prices fell in the first quarter, the Barclays Aggregate Bond index advanced 1.83% in the second quarter and long-term US Treasuries increased 5.79% in the second quarter – moving both closer to positive territory for the year-to-date.

Finally, commodities remained the stand-out performers in the second quarter. For the year-to-date, Energy, Industrial Metals, and Agriculture are sharply higher. Higher commodity prices reflect the acceleration in economic activity, inventory rebuilding, and supply constraints due to restrained post- COVID re-openings in emerging markets.

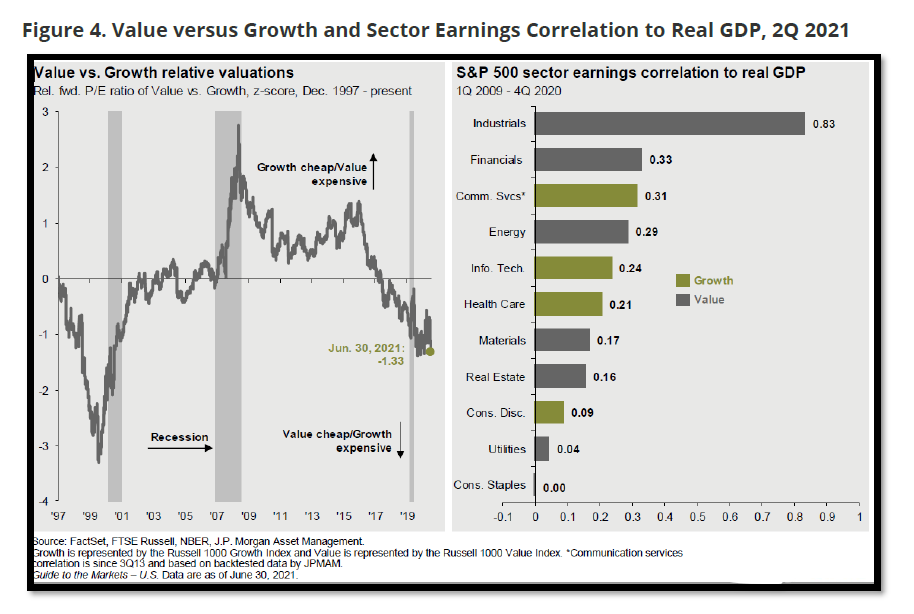

Notwithstanding the strength of the recent reversal, the longer-term performance gap, current valuations, and the economic backdrop continue to favor the economically sensitive sectors represented in the value category (see Figure 4).

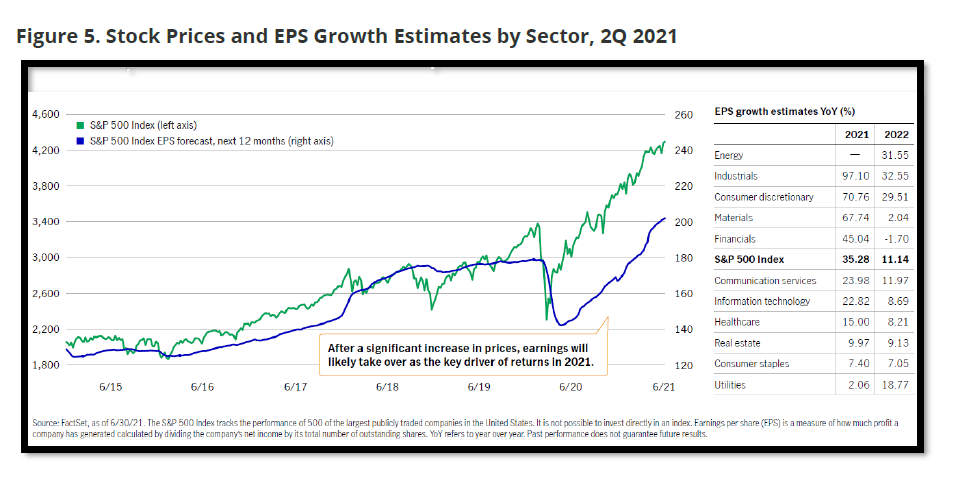

Equity markets are expensive, which is “normal” for this early stage of an economic recovery (see Figure 5). However, corporate profits are set to recover sharply through year end, continuing the pattern established in the first quarter. Just as we saw estimates chasing reported earnings downward in 2020, we will see the reverse this year. This is particularly true in Energy, Industrials, Consumer Discretionary, and Materials, which took the brunt of the decline during the pandemic.

Outlook – COVID Resurgence Increases Uncertainty

A historic bull market is underway. However, investors should prepare for choppiness and possible consolidation. The path of the coronavirus, interest rates, inflation, and the trajectory of the global economic recovery will determine the fate of the markets for the balance of 2021. Like 2020, investors who stay the course amid market volatility and conflicting prognostications, maintaining well- diversified portfolios geared toward achieving their long-term objectives, will continue to be rewarded.

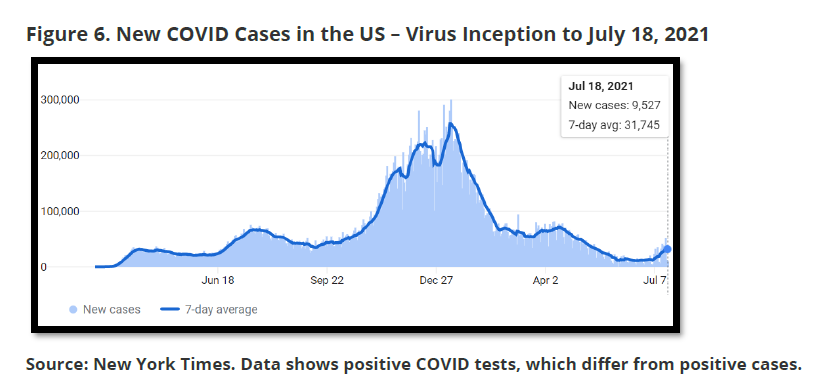

Source: New York Times. Data shows positive COVID tests, which differ from positive cases.

Recent COVID-related headlines are shocking:

- Over the past two weeks, new COVID cases in the United States tripled from a 7-day average of 11,752 on July 5th to 35,035 on July 19th.

- Five vaccinated Texas legislators tested positive following an unmasked flight to Washington DC.

- A Dutch music festival was linked to 1,000 new COVID cases.

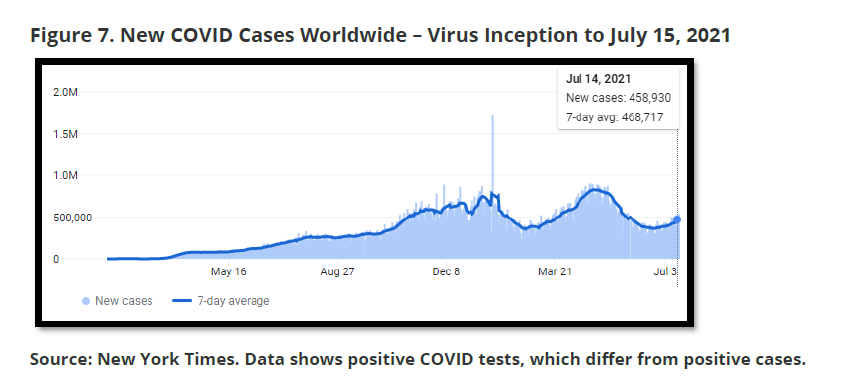

Amid headlines like these, it is easy to begin to believe quarantine, shutdowns, face masks, and further financial, societal, and personal upheaval cannot be far behind. However, it is important to remember that even with the increase, US COVID cases are 88% below the January peak of more than 300,000 new cases in a single day (see Figure 6). Globally, the number of cases also has increased in recent weeks, but also remains well below its January peak (see Figure 7).

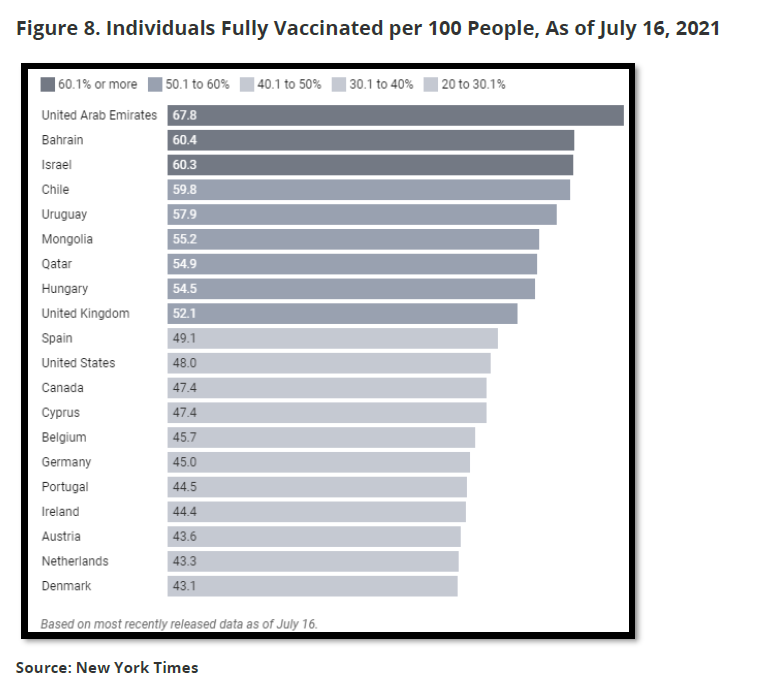

As of July 18th, 48.6% of Americans were fully vaccinated, according to the CDC data (see Figure 8). Vaccination administration rates peaked in early April — with the United States administering more than 3 million COVID-19 shots per day. However, vaccination rates have declined dramatically since this peak, once people who were most eager to get vaccinated received their shots. Anyone 12 or older is now eligible for a COVID vaccination in the US, vaccines are readily available, and it is well- documented that even if a vaccinated individual gets the virus, the symptoms are minimal to non- existent. Vaccines are also becoming more available outside the United States, which bodes well for stabilization in the number of cases globally. Against this backdrop, we do not anticipate a reversion to previous COVID lock-downs – and their dire consequences.

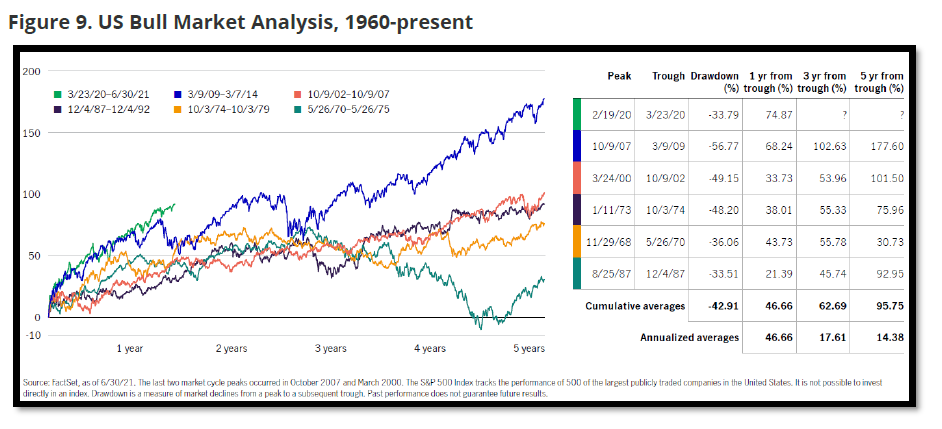

With the ebb and flow of coronavirus news, continued positive economic and earnings releases, pronouncements of interest rate stability from the Fed, and ongoing – albeit tempered – government spending, we expect continued volatility in the coming months – in an upward trend. As shown in Figure 9, the current US equity market recovery is proceeding in line with other bull markets – which bodes well for continued gains following a period of consolidation.

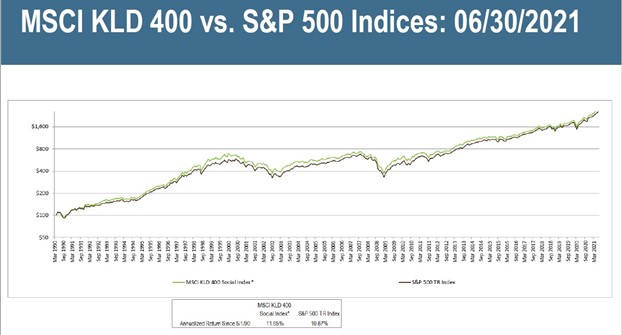

Achieving Long-Term Investment and Impact Objectives

The shift into sustainable, responsible, and impact (SRI) investments remains strong amid the global pandemic – along with rising climate risk awareness, social unrest, and growing recognition that financial and impact objectives can be achieved simultaneously. As shown in Figure 9, the MSCI KLD 400 index outperformed the S&P 500 index in the second quarter and year to date. The sustained, consistent performance of this standard SRI/ESG benchmark over time and recent outperformance support our view that strategies incorporating environmental, social and governance (ESG) factors – with an eye toward making the world a better place – and mainstream financial returns are not mutually exclusive.

According to US SIF, “total US-domiciled under management (AUM) using environmental, social, and governance (ESG) strategies grew from $12.0 trillion at the start of 2018 to $17.1 trillion at the start of 2020, a 42% increase. This represents 33% of the total US assets under professional management”. We anticipate continued growth going forward, with a shift toward increased scrutiny of ESG funds by investors, and a focus on impact performance measurement by asset managers.

As always, everything we do at First Affirmative is driven by our dedication to enabling advisors to deliver financial results to clients and belief in the power of capital to bring about lasting environmental and social change. Our three Sustainable Investment Solutions – Custom, Multi- Manager, and Managed Mutual Fund – are built to enable clients to achieve their financial goals over the long term, along with their individual environmental, social, governance, ethical, and values-based objectives. Each portfolio is carefully constructed to be well diversified across assets, sectors, geographies, securities, and management styles – and designed to weather periods of uncertainty and volatility.

First Affirmative Financial Network

5475 Mark Dabling Boulevard, Suite 108, Colorado Springs, Colorado 80918 719-478-7036 | www.firstaffirmative.com

Registered Investment Advisor (SEC File #801-56587)