Civility On Hold

By Mel Miller, CFA®, Chief Economist | Download PDF

The current political environment turned even more toxic during the fourth quarter of 2019. One can only hope that historians will look back on 2019 as the low point of civility. President Trump, impeached in the House of Representatives, following partisan wrangling in what observers feel was the most toxic hearing in U.S. history. The septic environment has bifurcated groups and families making for tense Holiday gatherings. Judged by friendly Republicans, the President will likely prevail in the Senate.

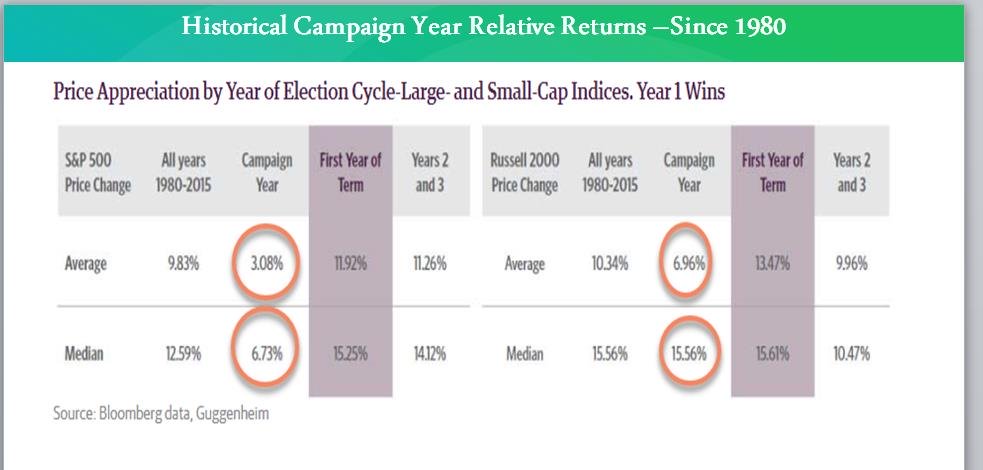

Animosity will continue as 2020 is an election year with the population subjected to negative political rhetoric, the primary cause of historically lower stock market returns.

As highlighted on the exhibit, the gains during an election year, on average, are lower than the other three years.

In the third quarter Economic Commentary, I stated I expected GDP (Gross Domestic Product) to slow to 1.75% – 2.00% during the quarter. The actual results reflected a quarterly increase of slightly above my forecast to 2.1%. Let’s now look at the current state of the economy.

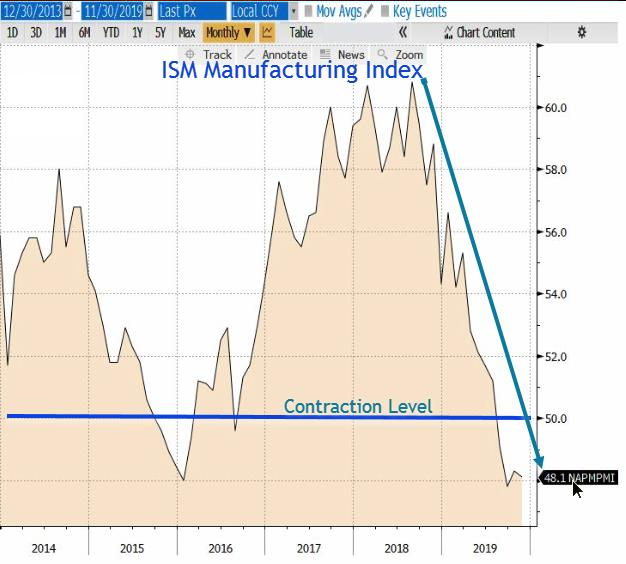

The manufacturing sector is suffering the most from the Trump-initiated trade war. The ISM (Institute for Supply Management) Manufacturing Index, having reached a high August 2018, has declined steadily since the beginning of the war and has entered the contraction area.

Companies have been diligent moving manufacturing facilities to non-tariff countries and seeking new supply chains. While not directly involved, the ISM Non-Manufacturing (Service) Index highlights a similar pattern, as lack of certainty negatively influences business decision-making. Uncertainty is the bain of the business sector and the equity markets.

A Phase One agreement announced December 15 is a positive sign. A review of past trade conflicts beginning in 1962, highlights eight trade conflicts which resulted in the implementation of targeted tariffs. The prior trade conflicts were single product-oriented ranging from bananas to commercial aircraft. The median period to settle a single-issue dispute is six years; therefore, history suggests the process to unwind tariffs on some 25% of all U.S. imports will not end soon.

Evidence of business slowdown and future uncertainty permeates sector economic releases. Year over year durable goods new orders currently are negative, and Capex (capital expenditures include the purchase of items such as new equipment, machinery, land, plant, buildings or warehouses, furniture and fixtures, business vehicles, software, or intangible such as a patent or license) remains sluggish.

While the business sector continues to slow, has the consumer picked up the slack? Retail sales have moderated throughout 2019 after reaching a high in July 2018. Retail sales for November underwhelmed as they increased only 0.2% over October. The Federal Reserve would welcome a robust December and will anxiously await the January pronouncements.

The Federal Reserve raised the Fed Fund’s borrowing rate on four occasions in 2018 to slow a perceived overheating economy. As the economy slowed in 2019, the Fed reversed course and lowered the rate three times.

How much did the economy slow in the fourth quarter compared to the 2.1% GDP growth experienced in the third quarter? I stated in the Fall Economic Commentary, a quarterly GDP of 1.50% – 1.75%, during the fourth quarter of 2019, and I stand by the forecast.

What lies ahead in 2020? I am afraid the poisonous political climate is not likely to change. The beginning of the year will bring about a trial in the Senate. The political partisanship, on occasion, will be put aside to pass needed legislation as occurred with the USMCA (United States-Mexico-Canada Agreement). Ratification in the Senate will probably follow shortly after the conclusion of the January impeachment trial. The USMCA deal adds significant labor enforcement rules, but in many ways, it is merely an improved NAFTA (North America Free Trade Agreement).

The key remains the political uncertainty surrounding the “trade war.” Just as the economy (GDP) slowed in 2019 as a result of the uncertainty, the underlying issues remain unchanged. Trade disputes, coupled with the risks of an election year and an impeachment trial, will not instill business confidence, let alone consumer confidence. Sluggish capital equipment investment is the likely result.

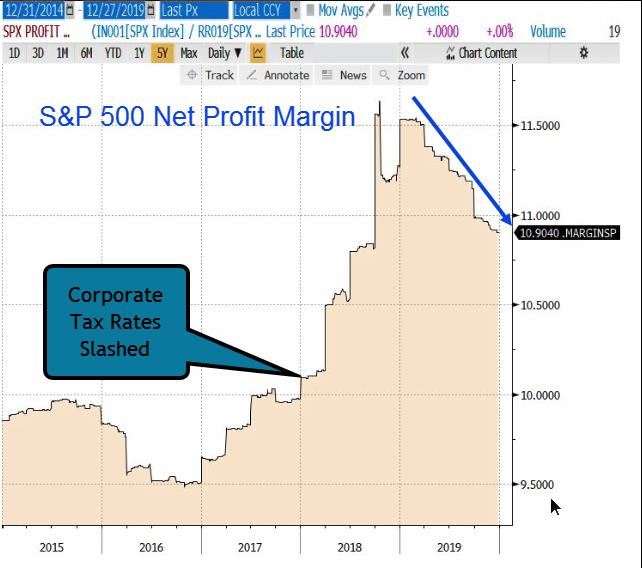

Following a tax cut implemented for the 2018 tax year, the effective corporate tax rate fell to slightly over 11%. The reduction accelerated profit margins in 2018 only to be followed by a steep decline in 2019 as wage costs and tariffs cut into the profit margin. A concern is a rise in the stock market as the net profit margin falls. Can this continue?

What will drive the consumer in 2020? Retail sales have averaged a 3.6% annual increase since 2014. The current annual rate of growth now is 3.3%, and the 180-day moving average is on the decline. In a contentious election year, I do not see a reversal in the retail sales trend.

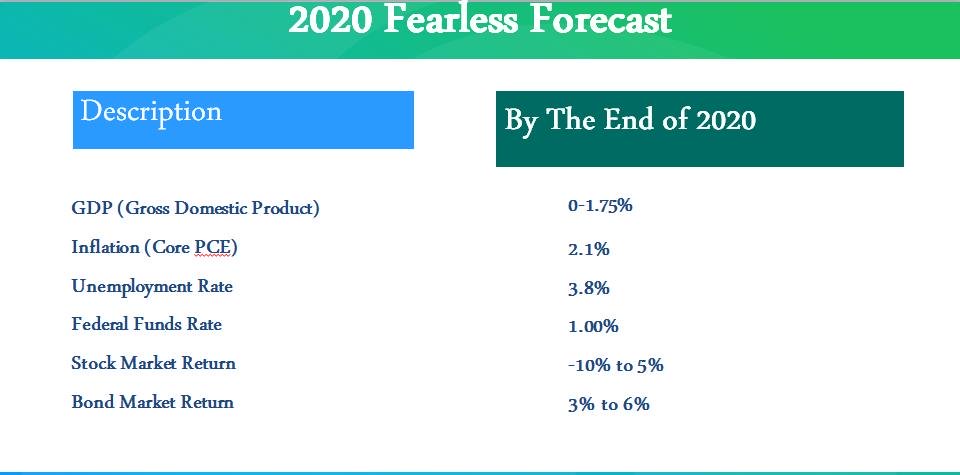

What is the likely Fed response to a slowing economy? Given my GDP forecast of 0 to 1.75%, I predict the Fed will need to lower the Fed Funds rate.

I predict the Fed will need to lower the Fed Funds rate two times (1/2%) to avoid a contraction. In the previous Economic Commentary, I raised my odds of a recession in the next twelve months to 50%. I see no reason to change my opinion.

I want to be proven wrong, but I am concerned about a slowing economy in 2020. If you are a political “junkie,” you will enjoy 2020!