Corporate profits to decline: Priced in or “the other shoe”?

Overview

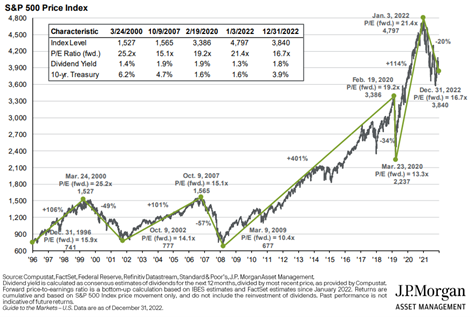

Inflation’s surge to a 40-year high in 2022 led the Fed to an unprecedented series of interest-rate increases, cratering the bond market and sending stocks tumbling. Following a 24.9% decline in the first three quarters 0f 2022, the S&P 500 advanced 7.6% in the fourth quarter, trimming full year losses to 18.1% (see Figure 1, below). As we enter 2023, equity valuations are more attractive (see Figure 2, page 2), inflation is decelerating, China is reopening following a long COVID hiatus, and a relatively warm winter has allowed Europe to side-step energy Armageddon. However, the US and European economies are slowing and could slip into recession and corporate profits are set to decline – possibly significantly. Ultimately, maybe as soon as early 2024, we anticipate interest rate stability and a return to trendline economic and profit growth, which points toward a choppy rebound in equity markets as the year progresses.

Figure 1. S&P 500 at Inflection Points – Bull and Bear Markets, 1996 to Date