Values-Aligned Investing and Industry News

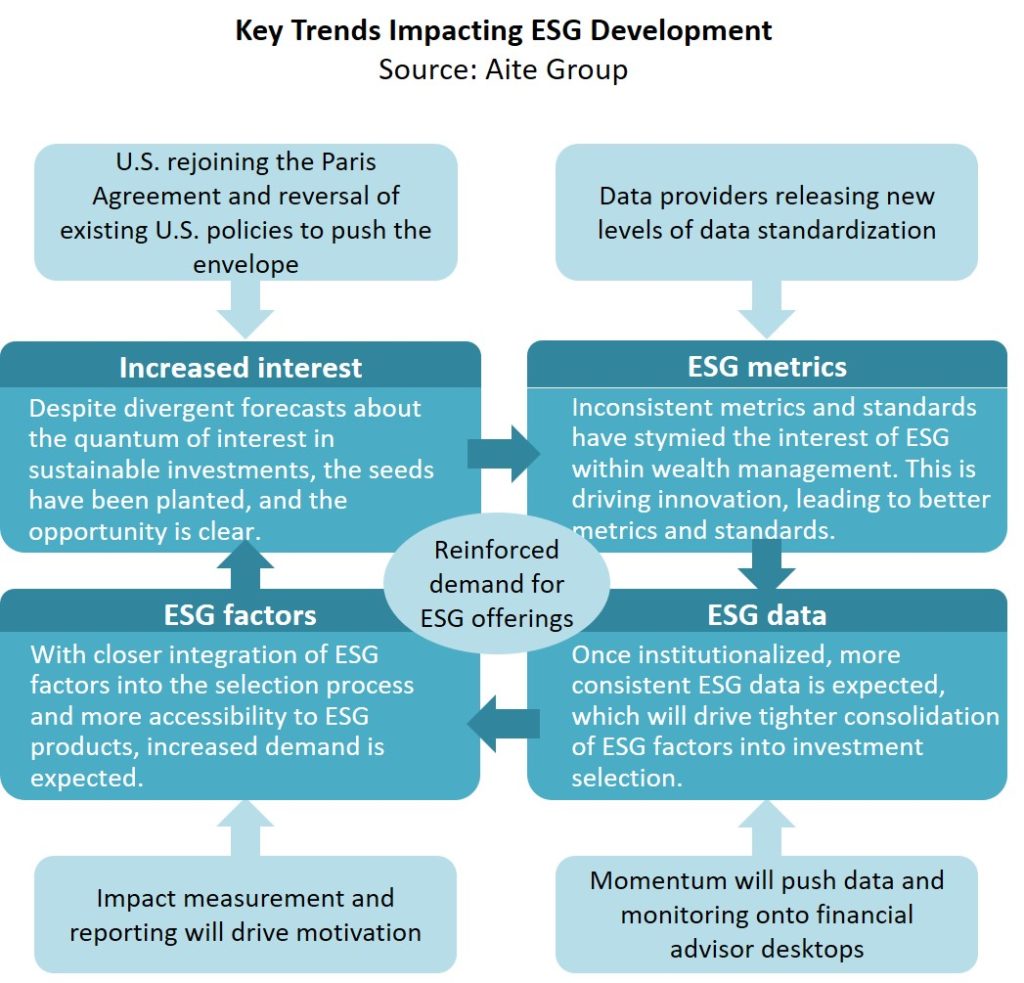

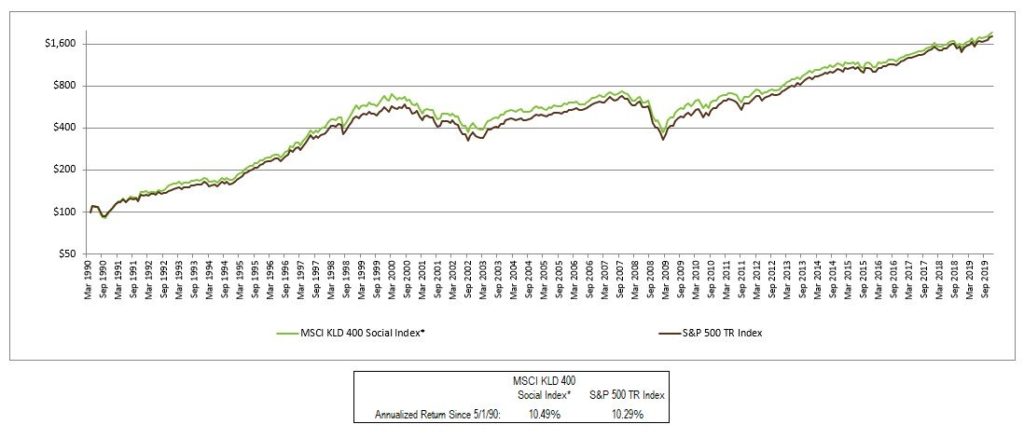

Investors are flocking to values-aligned investing. Information and big developments in the field come fast and frequent. Here you can find links to worldwide values-based investing news and the latest in First Affirmative advocacy.

SORT BY

- All

- Bond Overview

- Chronicles

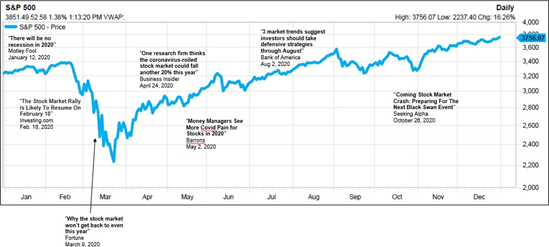

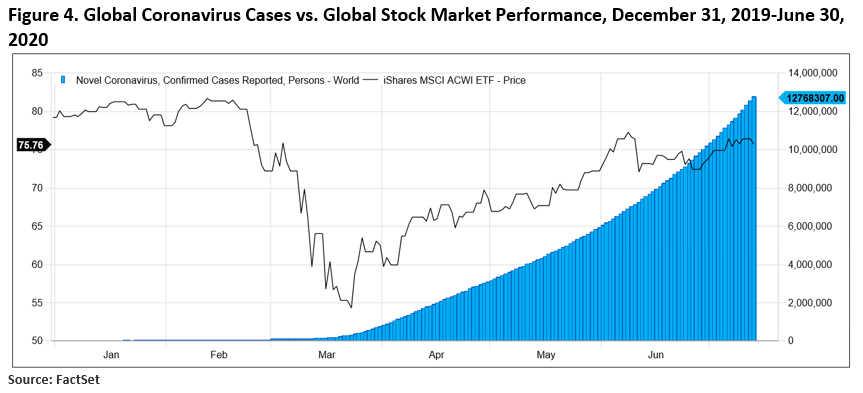

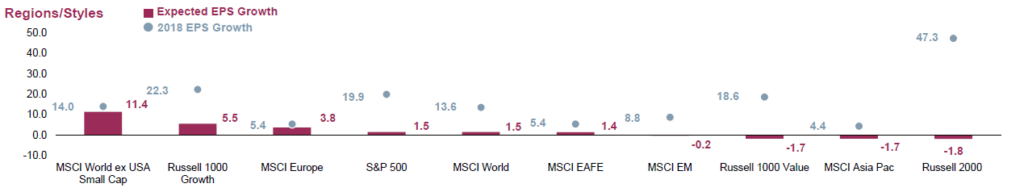

- Economic Commentary

- First Affirmative News

- Market Commentary

- News Releases

- News Story

- Podcast

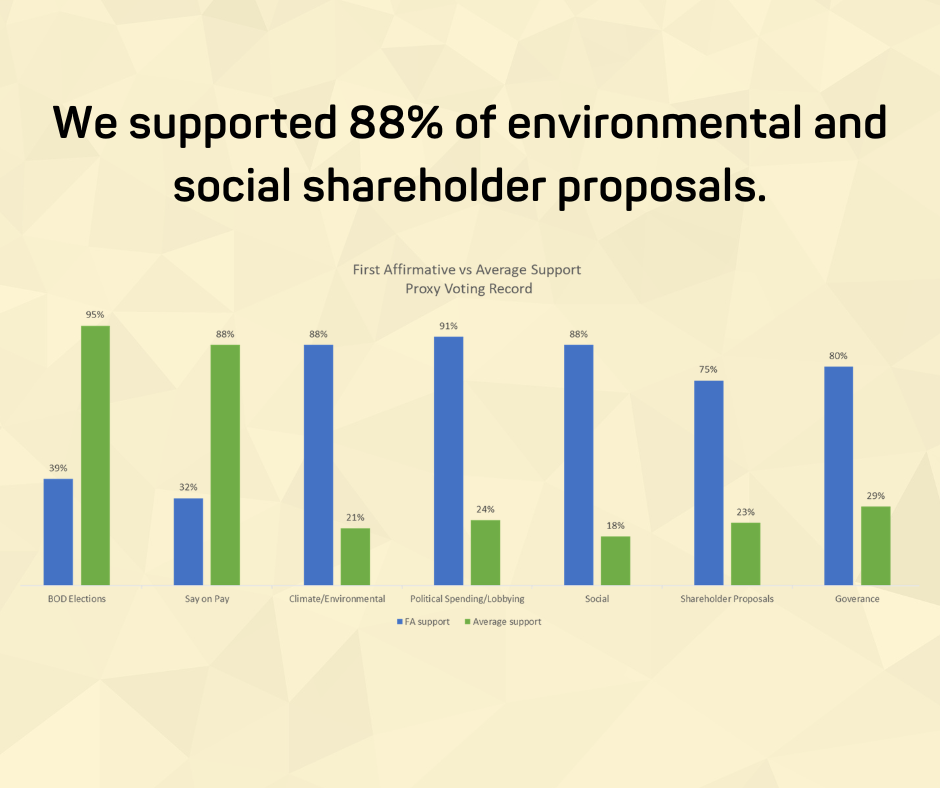

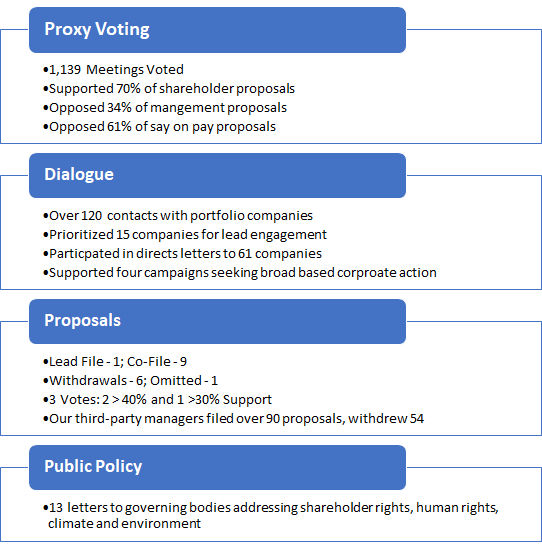

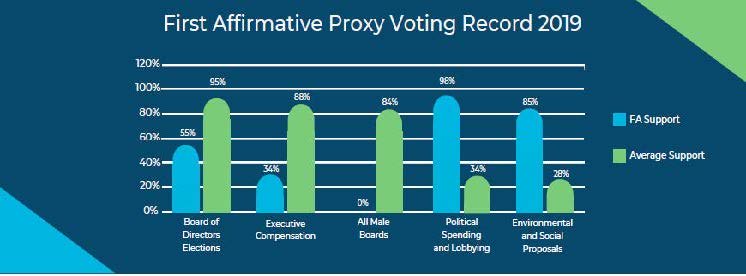

- Shareholder Advocacy

- VADIS News